Why Are Investors Leaving Asia?

A combination of rising U.S. bond yields, a strengthening dollar, and global economic uncertainty has made Asian equities less attractive to foreign investors. The U.S. dollar index hit a 26-month high of 110.17 in January, driven by strong U.S. labor market data and expectations that the Federal Reserve will keep interest rates elevated for longer. Investors also count on decreasing trade deficit from Trump-imposed draconic tariffs on US trading partners. This resulted in 10-year U.S. Treasury yields climbing to 4.809%, a 14-month high, making U.S. assets more appealing than emerging markets.*

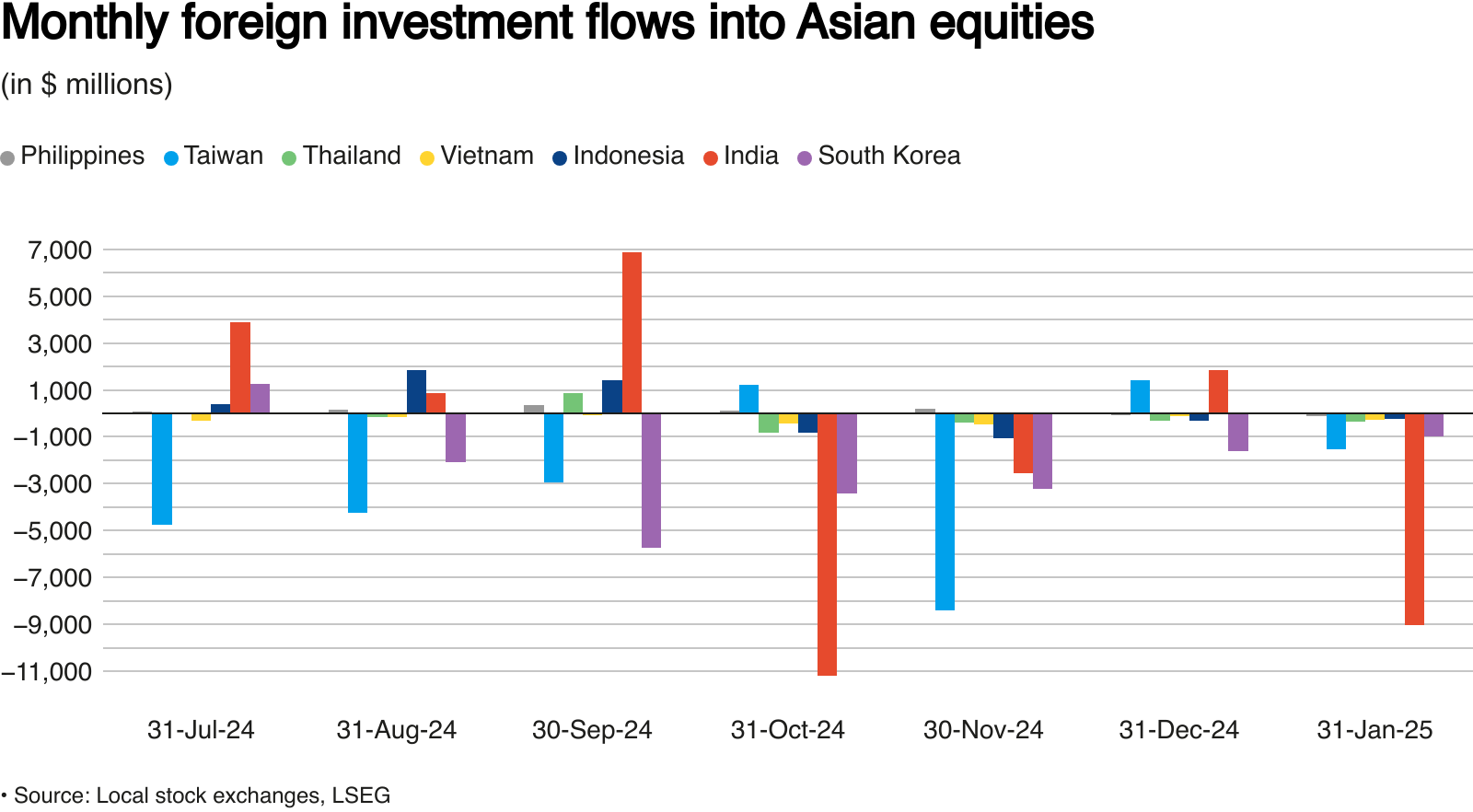

These factors have not only made investors more cautious but have also led to a reassessment of risk exposure in emerging markets. The effects have been particularly pronounced in India, where slowing domestic growth, coupled with global unrest, has discouraged foreign funds. In January alone, overseas investors sold $9.04 billion worth of Indian stocks, marking the second-largest monthly outflow in the country’s history.

Taiwan and South Korea also faced significant capital flight, with $1.52 billion and $1 billion exiting their markets, respectively. For these countries, part of this sell-off was driven by a shift in AI investment strategies. The rise of DeepSeek, a Chinese AI startup offering low-cost open-source AI models that we wrote about the previous week, has forced investors to reconsider the growth potential of AI capital expenditure, particularly in semiconductor-heavy markets like Taiwan and South Korea. This trend has triggered broader regional capital outflows, with foreign investors pulling $335 million from Thailand, $266 million from Vietnam, $229 million from Indonesia, and $114 million from the Philippines.

The Trade War Effect

Adding to investor uncertainty, the U.S. government implemented an additional 10% tariff on all Chinese imports, with Beijing retaliating by imposing new levies on U.S. goods, including oil, coal, gas, cars, and farm equipment. These measures, set to take effect on February 10, have further heightened fears of a prolonged trade war, which could weaken Asia’s export-driven economies even more.

The exodus of foreign investment has far-reaching economic implications for markets. When capital flows out of a country, several macroeconomic effects typically follow. Apart from Currency depreciation and stock market volatility, persistent outflows push borrowing costs higher to attract new capital.

Governments and businesses in emerging markets may be forced to offer higher interest rates, leading to tighter financial conditions that pressure central banks. This is particularly concerning for many Asian economies that rely on foreign investment to fund infrastructure, technology, and industrial expansion. A sustained decline in capital inflows can restrict development, limit job creation, and weaken consumer spending, ultimately leading to slower economic growth.

What’s Next?

With U.S. interest rates expected to remain high and global trade tensions intensifying, foreign investors may continue to steer clear of Asian equities in the near term. Unless economic conditions stabilize and risk sentiment improves, Asia’s financial markets could face prolonged volatility and weaker growth prospects.

For policymakers, the challenge will be to restore investor confidence through measures that promote economic stability, trade diversification, and financial resilience. Without decisive action, the region could see continued capital flight, making recovery even more difficult. We will continue to monitor the development in this area that highly relies on US foreign and trade policy.

* Past performance is no guarantee of future results.

Source: Reuters

.jpg)