Source: https://www.ey.com/en_us/insights/ipo/ipo-market-trends

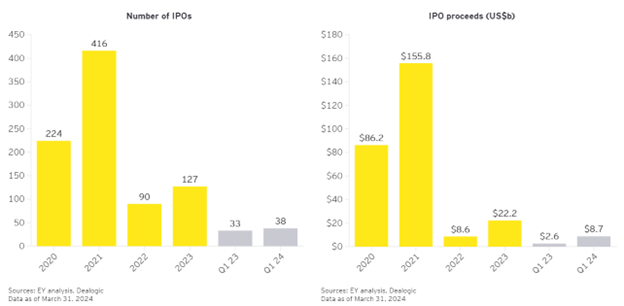

IPOs in the MENA Region

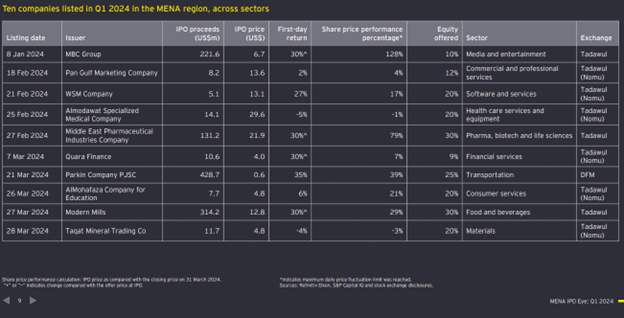

The MENA region, particularly Saudi Arabia, is experiencing a boom in IPOs. Investors worldwide are focusing on this country due to the decrease in new companies on the US market. In the MENA region, only one company outside Saudi Arabia went public: Parkin Company PJSC in the United Arab Emirates (UAE), offering 25% of its equity.

This IPO was the largest in the region, raising $0.4 billion, accounting for 37.2% of the total regional IPO value. The demand exceeded supply by an astonishing 165 times, causing the stock price to jump 35% on its first trading day.

IPOs in Saudi Arabia

The overall volume of IPOs on the Saudi exchange amounted to $724 million. Of the nine companies listed, three were on the Tadawul Main Market, with all seeing a maximum permitted increase of 30% on their first trading day. The remaining six listings occurred on the Nomu – Parallel Market, which has lighter listing requirements, generating total proceeds of $57 million.

Modern Mills: Produces and distributes cooking and baking flours, ingredients, and animal feeding products. Its IPO raised $314 million, offering 30% of its equity, with demand 127 times higher than supply.

MBC Group: A well-established media group focusing on information, interaction, and entertainment. Its IPO raised $222 million, offering 10% of its equity, with demand 66 times higher than supply.

Middle East Pharmaceutical Industries Company: Manufactures high-quality Active Pharmaceutical Ingredients. Its IPO raised $131 million, offering 30% of its equity, with demand 139 times higher than supply.

Sustainability and ESG Reporting

In addition to the success of companies entering the stock market, there is a growing emphasis on environmental protection here, as it is worldwide. The United Arab Emirates has issued a mandate for environmental, social, and governance (ESG) reporting guidelines for companies listed on the Abu Dhabi Securities Exchange marking a significant advancement in transparency and sustainable practices in the region's financial markets.

Following IPOs in 2024

According to EY, another 25 companies plan to list in this region in the remainder of 2024. Saudi Arabia leads with 21 announced IPOs, followed by one company in the UAE, Egypt and Algeria. Notable upcoming listings in Saudi Arabia include RASAN, Saudi Manpower Solutions Company (SMASCO), Miahona, and Panda Retail Company. Significant upcoming listings include LuLu Group or Etihad Airways.

RASAN is expected to enter the market on May 29-30, offering a digital transformation insurtech platform that provides technical solutions to the insurance brokerage and financial services sectors. The company has started its operation in 2017 and posted sales of $68 million with 28 % operating profit margin. Company offers its shares at price of $10. Clients of Tradematics will be able to trade Rasan on their Metatrader 5 platforms.

.jpg)