Source: CNBC

Immediate market reaction

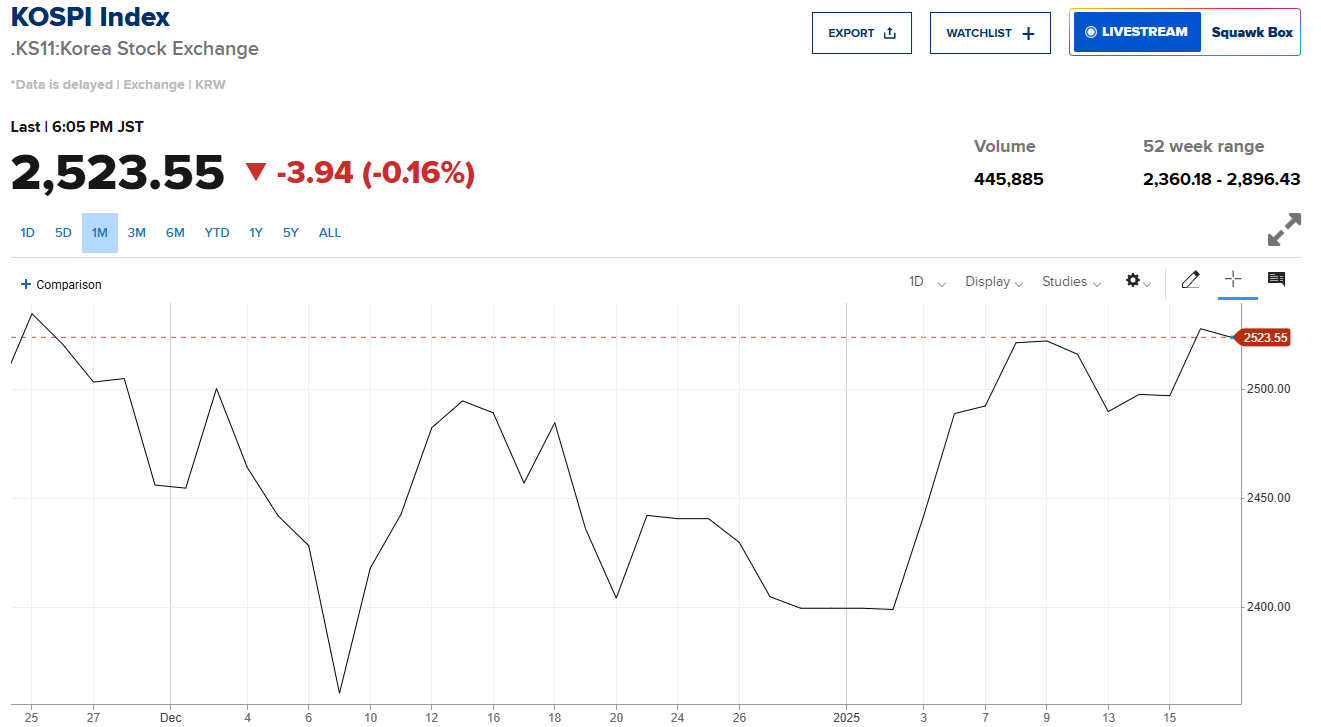

The beginning of this political turmoil had an immediate impact on South Korea’s stock market, particularly the KOSPI index, which in December plummeted to 2360 points, its lowest level in nearly a year following Yoon’s after a martial law was declared. The uncertainty surrounding the government’s stability created a wave of concern among investors. However, these losses were swiftly erased as the market demonstrated remarkable resilience. Just a week and a half after, the stock market hit the crucial 2500-point mark again and almost fully recovered from the fall.*

Later in the month due to absence of the Santa rally and pessimistic outlook regarding lowering interest rates by Fed, Korean main index Kospi, alongside other major global indices fell again. This fall was not as deep as the immediate market reaction; however, it took almost a month for it to make losses.*

Market reaction on Yoon’s arrest

By January 15, 2025, the KOSPI index had rebounded to 2,527.49 points, crossing back into the 2,500 range yet again, after four turbulent sessions. Similarly, other index, KOSDAQ, climbed to 724.24 points, its highest level since November 2024.* This recovery was driven by a combination of domestic and international factors, including the release of the U.S. Consumer Price Index (CPI) data, which eased inflation concerns and reignited investor confidence.

The arrest of President Yoon Suk Yeol will undoubtedly leave a lasting imprint on South Korea’s political history even though the stock market volatility was minimal. While the martial law declaration initially shook the market, the recovery demonstrates the ability of South Korea’s economy to adapt and overcome shocks, maintaining its status as a significant player in the global financial system. As the impeachment trial proceeds, the nation’s institutions continue to show their strength, ensuring accountability while balancing economic stability.

Other determinants of Korea’s stock market

Another key factor aiding the recovery is the favorable exchange rate of the South Korean won against the U.S. dollar*, which attracted significant foreign investment. Foreign investors purchased substantial stakes in blue-chip stocks such as SK Hynix, HLB or Samsung. Despite concerns raised by the Bank of Korea over exchange rate volatility, the central bank opted to maintain its benchmark interest rate low at 3.0%, further supporting market stability.

Another important determinant is the development of its largest trading partner – China. The world’s second biggest economy’s grow of 5% last year and met the government's target. However, the growth was uneven, with living standards declining for many citizens. This imbalance is raising further concerns about deeper structural issues in 2025. To achieve similar growth this year, China plans to rely more on debt, especially as it faces the potential challenge of higher U.S. tariffs under President Donald Trump, who takes office on Monday.

* Past performance is no guarantee of future results.

.jpg)