Q1 2024 Earnings Season

Over the final two weeks of the earnings season only a handful of companies are expected yet to report. Among them are Zoom, Costco, Salesforce, and Nvidia. So far, 92% of companies have presented their results, with 78% exceeding profit expectations and 59% surpassing revenue growth expectations. The average revenue growth of reporting companies stood at 5.4%.* Overall, this earnings season can be characterized as positive and slightly above average. Since artificial intelligence also belonged to the positively surprising segment, we expect Nvidia to do at least equally profitable as the benchmark’s average.[1]

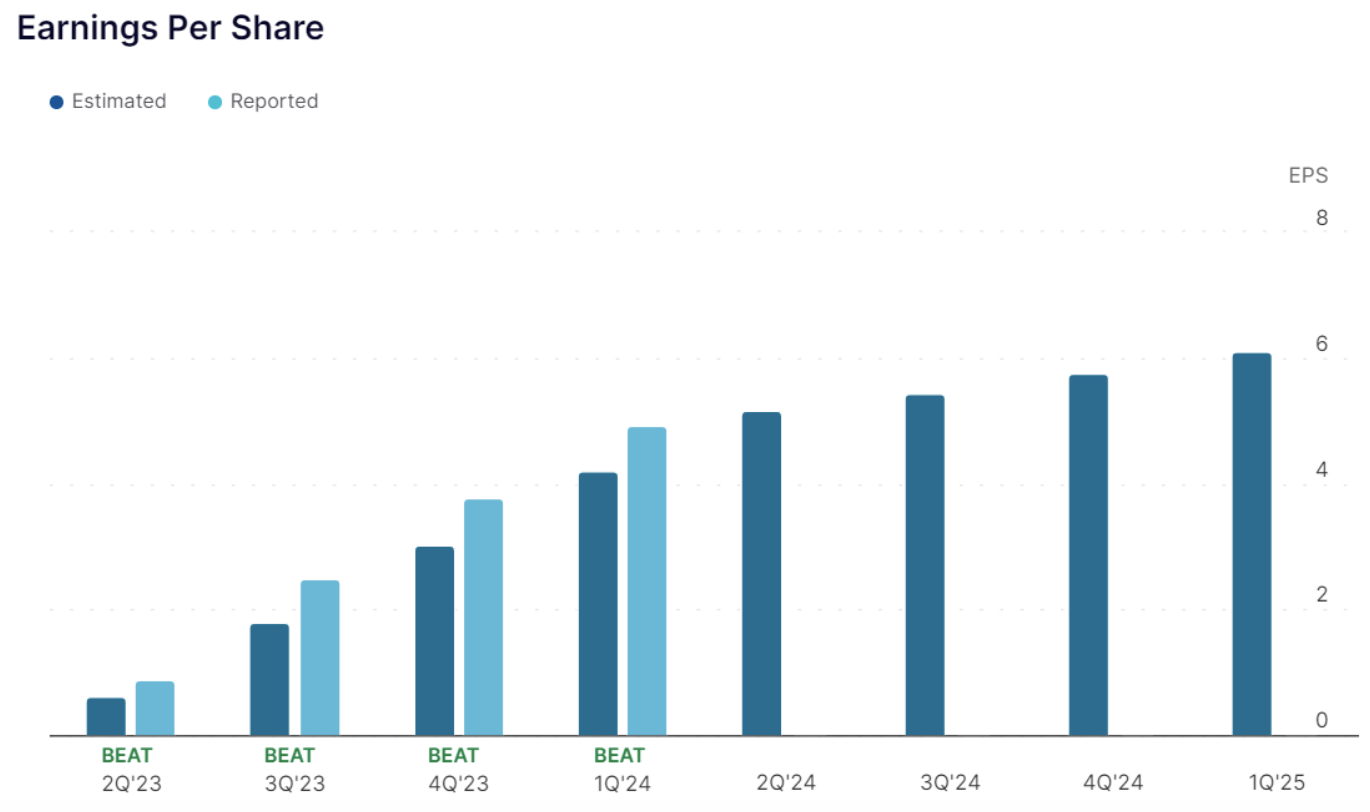

Nvidia's Past Quarterly Results

Nvidia's earnings per share have surprised analysts in each of the previous four quarters. The following graph shows the expected and actual earnings per share of the company. Although the degree of surprise is decreasing, reported results still significantly exceed analysts' expectations. This trend is expected to continue, given the ongoing strength of the current AI boom. Given that earnings per share is one of the most critical metrics for valuing any stock, these results are likely to trigger another significant increase in Nvidia's price.[2]

Source: https://www.nasdaq.com/market-activity/stocks/nvda/earnings*

What Does the Future Hold for Nvidia?

Nvidia's stock price has quadrupled over the past year, nearing the $1000 mark.* Despite the widely used option to buy fractional shares, a $1000 price tag is still high compared to other stocks. Analysts therefore agree that there is a high probability of a stock split, meaning the price will decrease, and investors will be compensated with an increase in the number of shares.[3]

If an investor owns a $100 stock and a 1:4 stock split occurs, they will receive four "new" shares for each "old" one. The stock price will simultaneously decrease by a factor of four. Previously, the investor's asset value was 1 x $100, but afterward it will be 4 x $25. Such a move usually increases interest in the stock, as it becomes more accessible than before.

In addition to the factors mentioned, it's worth noting that the revenue growth for the upcoming quarter for the benchmark is expected to be 10% higher compared to the same period the previous year in contrast to previously mentioned 5.4 % in Q1. This positive trend also applies to Nvidia, indicating fundamental support for the sustainable long-term growth of this stock.

Hence, we anticipate a surge in the stock price not only following Nvidia's first-quarter results but also in the foreseeable future.[4]

Direction of the Segment and the Market

While Nvidia is still perceived as a market leader, other startups and companies in this area are gradually making their mark. The advantage of investing in them is that their valuation is increasingly less dependent on segment leaders and is influenced by their own research and business models. Therefore, it is currently attractive not only to invest in Nvidia but also to diversify into other companies in this field.

Nvidia's results will also have a significant impact on the market. In the case of positive results and optimistic company outlooks, their influence on the market will be significant and growth oriented.[5]

So, to answer from the beginning Does Nvidia have room to grow? Is the answer definitely YES. Everything will be decided on Wednesday, May 22nd, after the market closes. Best of luck to all traders and investors.

Source: Yahoo Finance*

* Past performance is no guarantee of future results.

[1,2,3,4] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

.jpg)