What was the motivation?

It is known that the Chinese government is heavily subsidizing its EV automakers. This is also the result of the EU’s investigation, process that took place in October 2023. After producing an EV car, the Chinese government pays its automaker, so that it is able to sell it at a lower price. This practice is against World Trade Organization rules since it disturbs the market and eliminates competition. If this process was discovered within EU jurisdiction, heavy fines would follow.

This marks a big turnover in EU trade policy that is usually pro-trade and against imposing tariffs. Although the EU used trade defenses against China in the past, it had not done so for such an important industry. Still, this step cannot be interpreted as engaging in a trade war, since it will balance the competition in the EV industry. The other reason is that companies cooperating with the EU will be applied only 21 %, while uncooperating already mentioned 38.1 % tariff.

This step can be interpreted as effort of European policymakers to avoid repeating of what happened with solar panel producers a decade ago when the EU took only limited action to restrict Chinese imports resulting in many European manufacturers collapsing.

European EVs market

The European market with electric vehicles has no dominant player. The biggest brand, Tesla, had in 2023 market share of only 17.6 %, followed by Volkswagen with nearly 10 %. Between 5 and 6 percentage points follow BMW, Mercedes-Benz, Audi and MG.

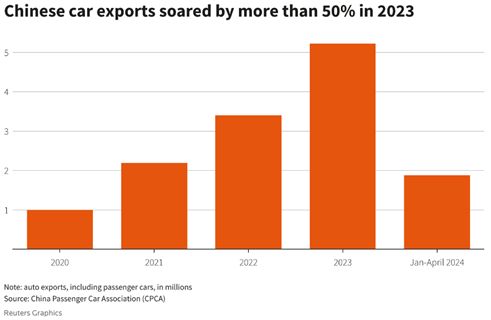

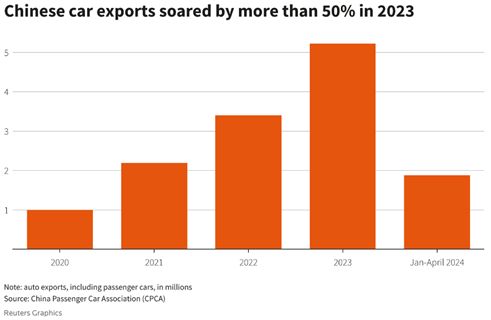

The big concern is the heavily rising share of Chinese brands, not only due to disruption of market competition but also because of safety concerns. Chinese EV share is expected to grow from 1 % in 2019 to 15 % in 2025, in line with the trend of the growth between 50 and even 100 %, effectively doubling every 2 years on average.

Reaction of the markets

It is EU carmakers that are upset with this decision, saying the EU Commission is harming European companies and European interests. All the EU’s biggest EV automakers are advocating against this step, arguing with free trade and concerns over spiraling the matter by Chinese retaliation that would at the end of the day hurt them more Chinese counterparts. In reaction, most of the EU’s EV automaker's shares fell due to concerns about China imposing high tariffs on European cars sold in the biggest Asian economy.

On the other hand, most of the Chinese EV automaker's shares rose, ranging from 1 to 3 percent, with BYD rising more than 7 % and the only company whose shares fell was China’s largest SAIC Motors. This reflects the general reaction of China, which predicts that  newly imposed tariffs will have only a very limited impact on their productivity and growth in the European market.

newly imposed tariffs will have only a very limited impact on their productivity and growth in the European market.

Risk Warning:

Trading in leverage products carries a high level of risk and may not be suitable for all investors. Past performance of an investment is no guide to its performance in the future. Investments, or income from them, can go down as well as up. You may not necessarily get back the amount you invested. All opinions, news, analysis, prices or other information contained in our communication and on our website, are provided as general market commentary and do not constitute investment advice, nor a solicitation or recommendation to buy or sell any financial instruments or other financial products or services.

.jpg)