A Successful Quarter

Eighteen companies collectively raised HK$8.6 billion during the second quarter, up from 12 companies in the first quarter, representing a 79% increase in funds raised, according to the exchange's 2024 interim report. The exchange's CEO noted that another 100 companies are in the pipeline, waiting to go public.

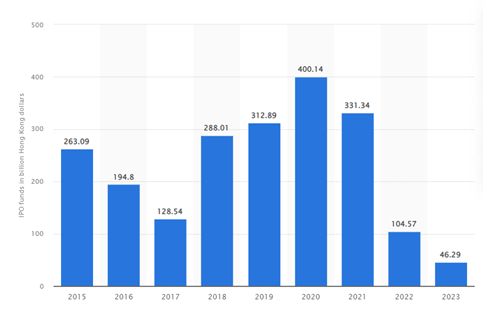

While this trend shows improvement from the first quarter of 2024, IPO volumes remain significantly lower than those seen in 2021 and earlier. Despite the second-quarter growth, 2024 might record extremely low numbers.

Issuing volume of IPOs at the Hong Kong Stock Exchange

(in billion Hong Kong dollars)

Source: https://www.statista.com/statistics/981246/hong-kong-ipo-issuance-volume/

The Support of Venture Capital

On June 19, China's State Council announced a series of policies and measures to promote the development of venture capital. Prior to that in April, to attract this venture capital and create a more favorable investment environment, five key measures were announced to enhance the Hong Kong and Shenzhen Stock Connect:

Expand the scope of eligible ETFs under the schemes.

Include real estate investment trusts (REITs).

Support the inclusion of RMB-denominated stocks in southbound schemes. (RMB is official name for Chinese Yuan)

Enhance mutual recognition of funds.

Support the listing of leading mainland companies in Hong Kong.

First Success of These Efforts?

Following the announcement of these measures at the start of the second quarter, a notable increase in IPO funds has been recorded. Among the largest IPOs are Cirrus Aircraft, a small jet manufacturer from Minnesota, aiming to raise up to US$197 million. The company was acquired in 2011 by China's state-owned Aviation Industry General Aircraft.

Other significant IPOs include Chenqi Technology, which offers an app for personal transport services and is raising US$174 million, and AI firm Shanghai Voicecomm, which is seeking to raise US$85 million.

.jpg)