Market Tensions Caused Yields to Climb

While short-term JGB yields remain relatively stable due to diminished expectations of near-term rate hikes, long-term yields have surged. This reflects investor anxiety over inflation, fiscal expansion, and a potential oversupply of government debt and their impact on the economy, particularly in the long-term period.

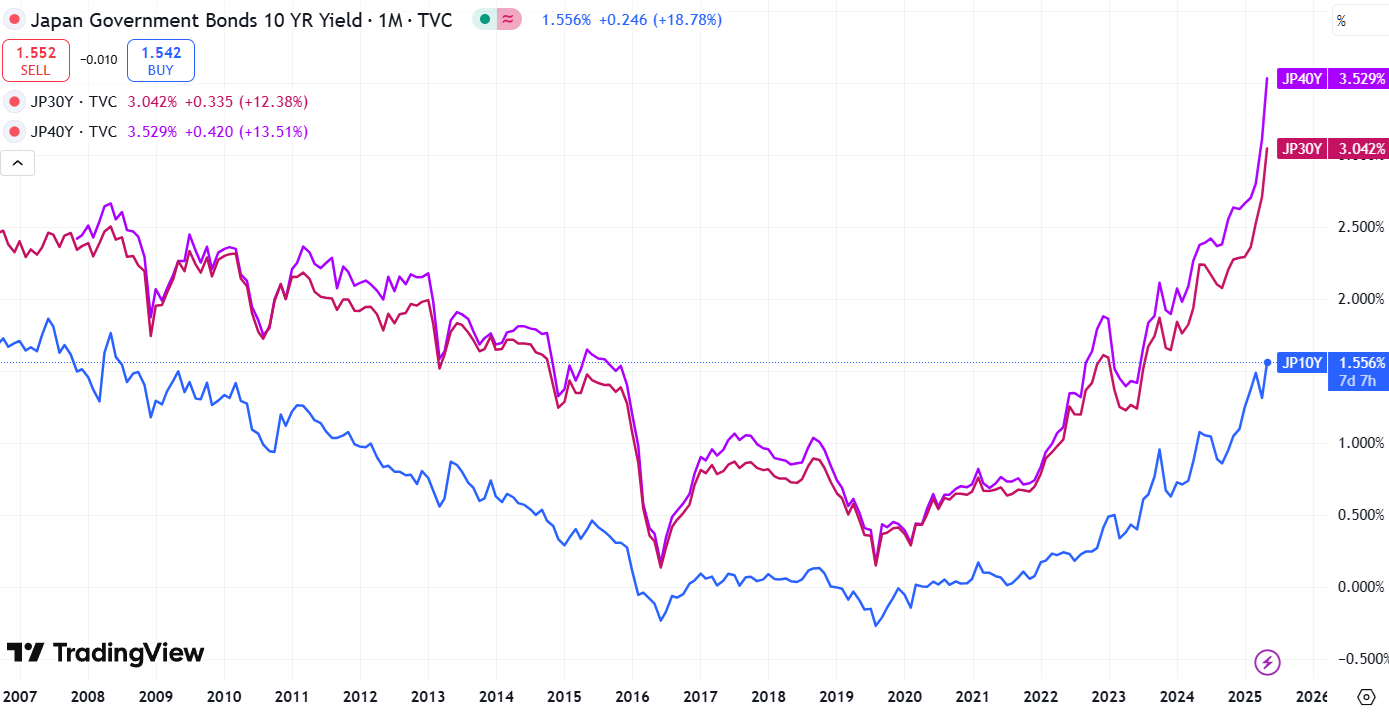

A vastly weak 20-year bond auction this week underscored concerns about the market’s capacity to absorb new tariff war impacts. The 30-year yield briefly hit a record 3.185% before retreating to 3.115%, while the 40-year yield fell to 3.6% after touching an all-time high of 3.675%. On the graphics below we display benchmark for long-term yields, the 10-year-old bond compared to 30- and 40-year-old.

Source: TradingView

BOJ Dilemma of Inflation Pressures

The timing is critical for the BOJ, which is preparing to reassess its bond-buying program next month. Additionally, April’s inflation data showed core consumer prices rising 3.5% year-on-year, the fastest pace in over two years.

This keeps pressure on the BOJ to continue using its easing monetary policy. On the other hand, some political factions are advocating for large-scale fiscal stimulus and even cuts to Japan’s consumption tax in response to the rising cost of living, which would both be highly inflationary. BOJ’s main job is to balance supporting economic growth and managing inflation expectations which can often lead to situations like this, when central banks need to make unpopular decisions.

Fiscal Sustainability in Focus on a global scale

At the G7 summit of finance ministers ending on Thursday, Japanese Finance Minister Katsunobu Kato highlighted concerns about global fiscal sustainability. The G7 release emphasized the importance of boosting long-term growth and countering rising public debt. Discussions also confirmed commitments to market-determined exchange rates and the avoidance of excessive currency volatility.

Despite a slight recovery of Japanese government bonds on Friday in response also to this press release, analysts warn that risks remain high, particularly as auctions for super-long bonds are scheduled for the coming week.

.jpg)