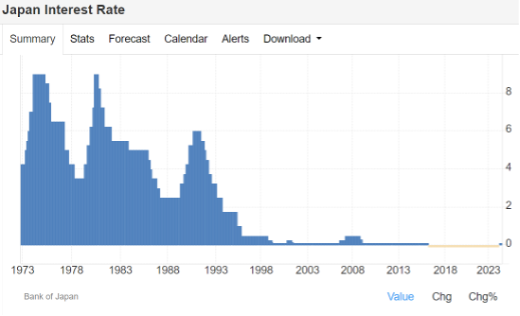

Change in Interest Rates

While the United States has raised interest rates 11 times since COVID-19, bringing inflation from 0 to 5.5%, Japan has changed its monetary policy only once since 2016. The Bank of Japan (BoJ) raised interest rates from -0.1% to +0.1% on March 19, 2024, primarily to strengthen its currency. In the upcoming meeting, Japan’s central bank may intervene again.

The BoJ has hinted that its quantitative tightening (QT) plan for July could be more aggressive than markets expect, potentially including an interest rate hike. Hawkish signals over the past week highlight the pressure on the BoJ to bolster the yen. Additionally, there has been a reported significant decrease in bond buying.

Source: https://tradingeconomics.com/japan/interest-rate

The Effect of QT on Japan's Economy

One of the well-known features of the Japanese economy is its extremely low inflation, often bordering on deflation over the past 35 years. This has resulted in near-zero economic growth. To combat this, the BoJ has been attempting to raise inflation to a generally accepted 2% level through massive quantitative easing. Despite keeping interest rates near zero for 35 years, inflation has remained low, largely due to cultural resistance to price increases.

While a weaker yen boosts profits from exports, it also exposes the Japanese economy to “bad” inflation, characterized by rising prices of imported goods, which Japan heavily relies on. This type of inflation has the potential to disrupt the entire economy and must be addressed appropriately.

Decrease in Bond Buying

At its July meeting, the BoJ announced a plan to reduce its $5 trillion balance sheet by cutting back on its massive bond-buying program. This move is intended to help appreciate the Japanese currency.

However, central bankers must ensure their policies are ambitious enough to convince financial markets. If rate hikes or decreases in bond buying are seen as insufficient, the yen will continue to fall.

Conclusion

Japan’s current economic strategy involves a delicate balancing act. While efforts to strengthen the yen and control inflation are necessary, they must be executed with precision to avoid further economic instability. The BoJ's future actions will be crucial in determining the trajectory of the yen and the overall health of the Japanese economy.

.jpg)