Source: Reuters

Federal Reserve: A Pause Before Expected Cuts

In its latest meeting, the U.S. Federal Reserve kept interest rates steady at 4.25%–4.50% but signaled potential rate cuts later this year. Fed Chair Jerome Powell cautioned that inflationary pressures, particularly those driven by U.S. tariffs, could slow progress in reducing inflation. However, the central bank remains on track to lower borrowing costs by 50 basis points by year-end, with market expectations of a 66% probability of a rate cut in June.

The Fed’s cautious stance reflects a balancing act between supporting economic growth and controlling inflation. Inflation projections have been revised upward, while economic growth forecasts have been downgraded due to the impact of new tariff policies introduced by the Trump administration. These tariffs, including higher duties on steel and aluminum imports, have raised concerns about rising costs.

Asia’s Cautious Approach

Japan’s central bank has opted to keep rates steady this week, even as it embarks on its first rate-hiking cycle in decades. Inflation remains above the 2% target, with the Consumer Price Index at 4% and core CPI at 3.2%, prompting expectations of gradual tightening. Bank of Japan Governor Kazuo Ueda has expressed concerns over global economic uncertainty and the potential effects of U.S. tariffs. Meanwhile, rising domestic wage growth could sustain inflationary trends, making further policy adjustments likely.

Taiwan’s central bank has maintained its benchmark discount rate at 2%, prioritizing inflation control while monitoring the limited impact of U.S. tariffs on its export-driven economy. Taiwan’s economy, which grew 4.59% in 2024, relies heavily on semiconductor exports—a sector under scrutiny due to potential new trade restrictions. Central Bank Governor Yang Chin-long emphasized that current conditions do not justify monetary easing, keeping inflation forecasts stable at 1.89%.

Gold Surges to Record Highs

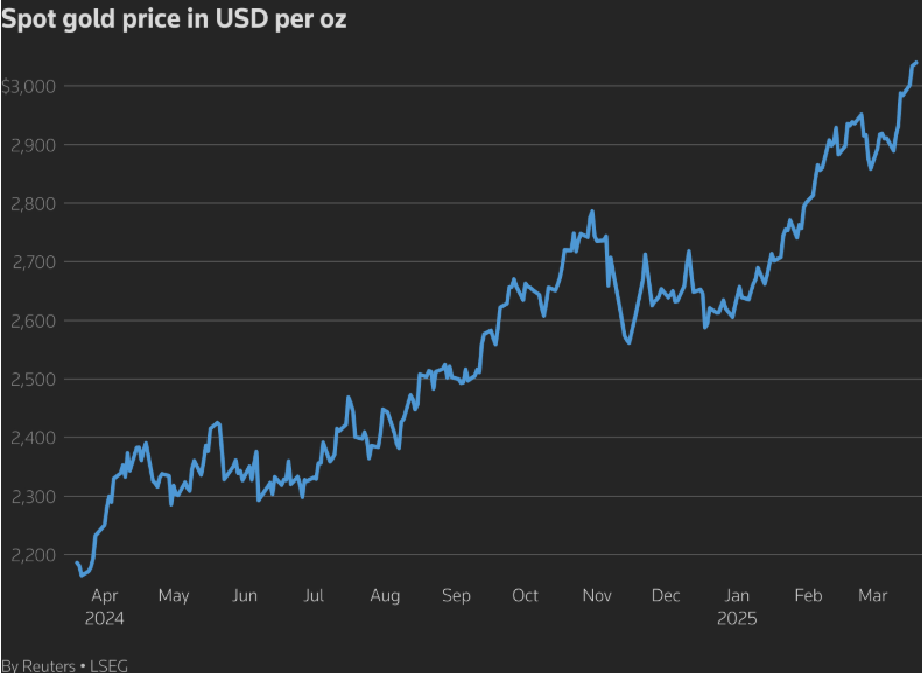

As a reaction to monetary policies, gold prices have skyrocketed to an all-time high of $3,051.99 per ounce, driven by expectations of U.S. rate cuts and also growing economic uncertainty.* As a safe-haven asset, gold becomes more attractive when interest rates decline since it does not yield interest. It also serves as a hedge against inflation and financial instability, making it a preferred investment in uncertain times.

The recent gold rally was fueled by Powell’s remarks on potential delays in reducing inflation, along with geopolitical tensions, particularly between Russia and Ukraine. Additionally, trade instability due to the Trump administration’s tariff policies has pushed investors toward gold as a protective measure against economic volatility.

Market analysts predict that gold could continue its upward trajectory as uncertainty persists. The Fed’s expected rate cuts make gold an appealing investment, as lower interest rates reduce the opportunity cost of holding the metal.

Conclusion

The global monetary policy landscape remains unstable as central banks in the U.S., Japan, and Taiwan respond to inflationary pressures, trade policies, and broader economic conditions. While the Federal Reserve prepares for possible rate cuts, Japan prepares for tightening its policy, and Taiwan holds steady amid trade uncertainties, gold’s newest all-time high rally emphasizes investor concerns over inflation and geopolitical risks, solidifying its status as a key asset in an unpredictable financial environment.

* Past performance is no guarantee of future results.

.jpg)