Source: Yahoo Finance

Expectations were high but results even higher

The company's revenue of $26 billion exceeded analysts' estimates of $24.7 billion, marking an 18% increase from the previous quarter and a remarkable 262% surge compared to the same period last year. Profits soared to nearly $15 billion, compared to just $2 billion a year ago.

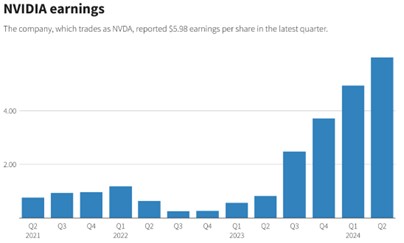

Earnings per share under GAAP methodology reached $5.98, outperforming expectations of $5.59, with quarterly and yearly increases of 21% and 629%, respectively. Nvidia's guidance for the following quarter is $28 billion, with analysts' consensus at $26.7 billion.

What else did Nvidia announce?

Nvidia also announced stock split 10:1, meaning that the value of its stocks will be divided by 10, while the number of shares will be increased 10 times. If an investor owns one $1000 Nvidia stock, he will have 10 shares worth 100 dollars. We write more about stock split in our previous analyses.

To this stock split will be adjusted dividend payment, currently 0.04 US dollars per share. Dividend will be increased to 0.01 US dollars per new share. This represents a 150 % increase.

To these exceptional results did Nvidia’s stock price increased by 7 % in post market trading, adding $140 billion of market capitalization contributing to a 0.5% rise in S&P 500 futures and a 1% increase in NASDAQ futures.

Source: https://www.reuters.com/markets/us/global-markets-view-usa-2024-05-23/

Fed still delays first rate cut

The exceptional filings of Nvidia hold significant sway over the current market dynamics. As one of the foremost market movers, Nvidia's impact is particularly pronounced in an economic landscape grappling with persistently low inflation rates. The US central bank's reluctance to reduce interest rates reflects fears regarding the resurgence of inflationary pressures.

In such a scenario, positive news serves as a catalyst, fueling the ongoing market rally. Investors and traders must remain vigilant, closely monitoring market movements to determine future trends. Given that Nvidia was among the last major companies to report its Q2 results, which have contributed to sustaining the bullish trajectory, the performance of the market needs to be watched even more closely.

* Past performance is no guarantee of future results.

.jpg)