Source: Yahoo Finance

ASML Situation

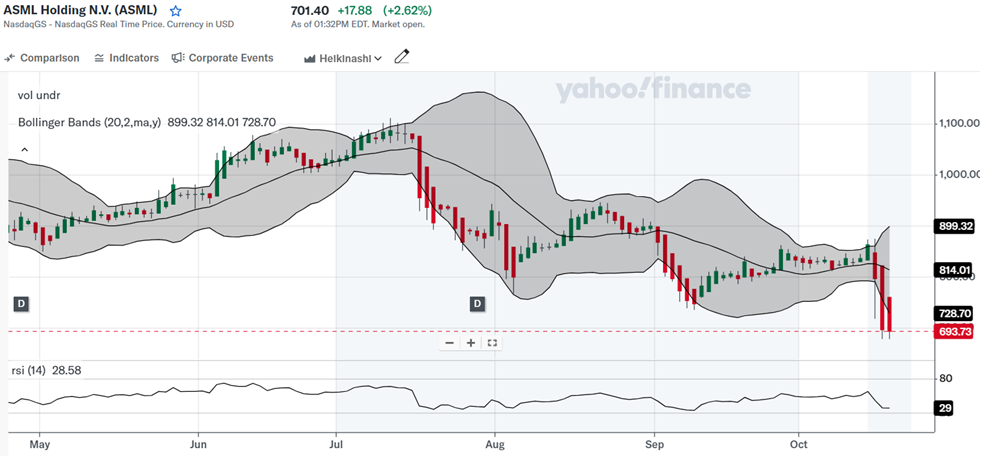

ASML, Europe’s most valuable technology company, saw a dramatic drop in bookings for Q3 2024, plunging from €5.5 billion in Q2 to just €2.6 billion. This sharp decline led to a significant selloff, with shares tumbling by 16% on Tuesday, the biggest fall in two decades.* The company attributed this to a slowdown in non-AI markets and delayed orders. While ASML's position as a key supplier of chipmaking equipment remains secure, there are growing concerns about short-term sales and the company’s ability to sustain growth above market levels over the long term.

By the end of the week, ASML’s shares had dropped by an additional 6%, settling around €700—far below their July peak of over €1,000, a record high driven by ASML’s dominance in lithography machines critical for chip production.*

ASML Q3 Results

In its Q3 2024 report, ASML recorded total net sales of €7.5 billion, up from €6.2 billion in Q2. Net profit reached €2.1 billion, up from €1.6 billion, and the gross margin increased to 50.8%. Earnings per share stood at €5.28.* New orders for the quarter totaled €2.6 billion, down by 50% of which €1.4 billion came from EUV technology. Apart from slashed new orders by more than 50%, the numbers were impressive.

The company guidance Q4 sales between €8.8 billion and €9.2 billion, with a gross margin of 49-50%. Looking ahead to 2025, ASML expects sales in the range of €30-35 billion, with gross margins between 51% and 53%.

Source: Yahoo Finance

TSMC Situation

On the other hand, TSMC, the world’s largest chipmaker, saw its shares surge by nearly 9% on Thursday after posting strong Q3 results and raising its sales outlook.* The company’s upward revision highlighted booming demand for AI chips, which are expected to form a large part of its annual revenue.

This positive momentum pushed TSMC’s stock above $130, taking its market capitalization past $1 trillion for the first time.* Investors took this as a sign of strength for the broader semiconductor sector, fueled by rising AI investment from major tech firms.

TSMC Q3 Results

Despite broader concerns about a slowdown in semiconductor demand, particularly for AI-related chips, TSMC’s outlook reinforced confidence in the sector. The company’s Q3 results showed a 39% year-over-year increase in revenue, reaching $23.5 billion. Net income and earnings per share both soared by more than 54%. TSMC’s gross margin for the quarter stood at a robust 57.8%, while the net profit margin hit 42.8%, illustrating the continued demand for AI chips and smartphones.

Impact on the Technology Sector

TSMC’s upbeat results had a ripple effect across the U.S. chip sector. Shares of major players like Nvidia, AMD, Broadcom, Qualcomm, and Micron rose by up to 3%. Nvidia, one of TSMC’s key clients, saw its shares climb more than 2% as analysts linked TSMC’s strong performance to Nvidia’s outlook. Even Intel, which has faced challenges recently, enjoyed a 1.3% rise.*

This broad rally suggests that despite ASML's struggles, investor sentiment remains positive for the tech sector, particularly for AI and chip manufacturing companies. The industry may continue the rally that began in mid-September, supported by strong guidance from several key players. [1]

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

.jpg)