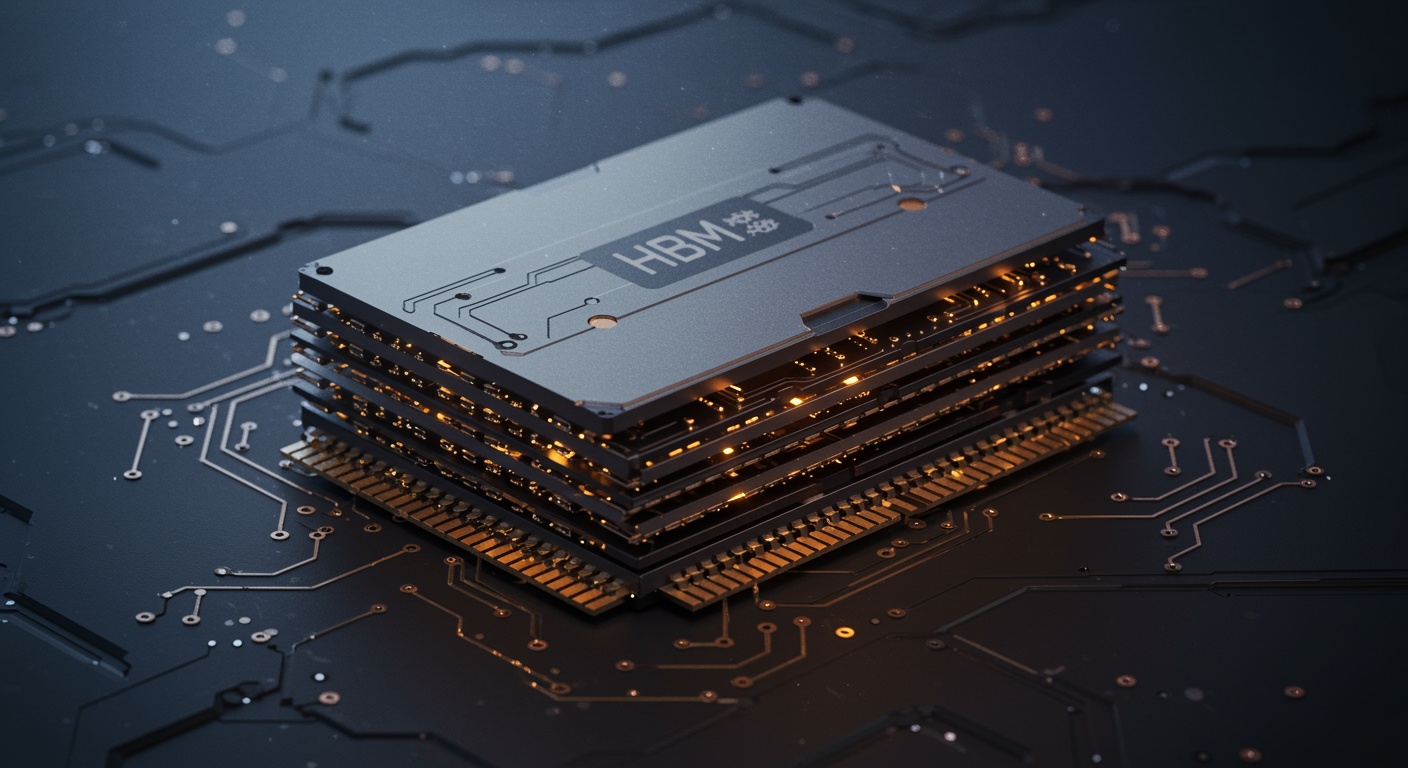

Samsung Electronics recently achieved a significant milestone with its fifth-generation high-bandwidth memory (HBM) chips, known as HBM3E, which have successfully passed Nvidia's rigorous testing protocols for use in artificial intelligence (AI) processors. This development represents a major step forward for Samsung, one of the world's largest memory chip makers, as it seeks to strengthen its position in the competitive HBM market, which is currently dominated by its local rival SK Hynix.

Breakthrough in HBM technology

Samsung's approved eight-layer HBM3E chips are poised to set new standards in the processing capabilities needed for advanced AI applications. HBM, which stands for high-bandwidth memory, is a type of dynamic random-access memory (DRAM) that is essential for graphics processing units (GPUs) used in AI. It enables vertical stacking of chips, saving space and reducing power consumption when processing the huge data load generated by complex AI tasks.

Competitive landscape and market dynamics

Although Samsung and Nvidia have not yet entered into an agreement to supply HBM3E chips, successful qualification indicates that shipments could begin in the fourth quarter of 2024. This development is particularly timely as Samsung is actively working to overcome the heat and power consumption issues in its HBM designs that were previously cited as barriers to meeting Nvidia's standards.

This announcement has a positive impact on Samsung's market position, particularly as it continues to catch SK Hynix, the HBM market leader, and is set to ship its 12-layer HBM3E chips at the same time. SK Hynix is a major supplier of HBM chips to Nvidia, indicating competitive pressure on Samsung to accelerate its innovation in this technology segment. [1]

Financial impact and investor outlook

Shares of Samsung Electronics were up 3.0%[1] following the announcement, outperforming the broader market's 1.8% increase, indicating strong investor confidence in Samsung's growth trajectory in the sector.* Analysts predict that HBM3E chips will become the main HBM product on the market this year, with shipments expected to be concentrated by the second half of the year.

Samsung's advances in HBM technology and the expected increase in market demand, which is estimated to grow at 82% per annum until 2027, indicate significant revenue potential. Although Samsung does not provide a specific breakdown of revenue from its chip products, analysts estimate that a significant portion of its DRAM chip revenue could come from HBM sales. [2]

Technical perspective

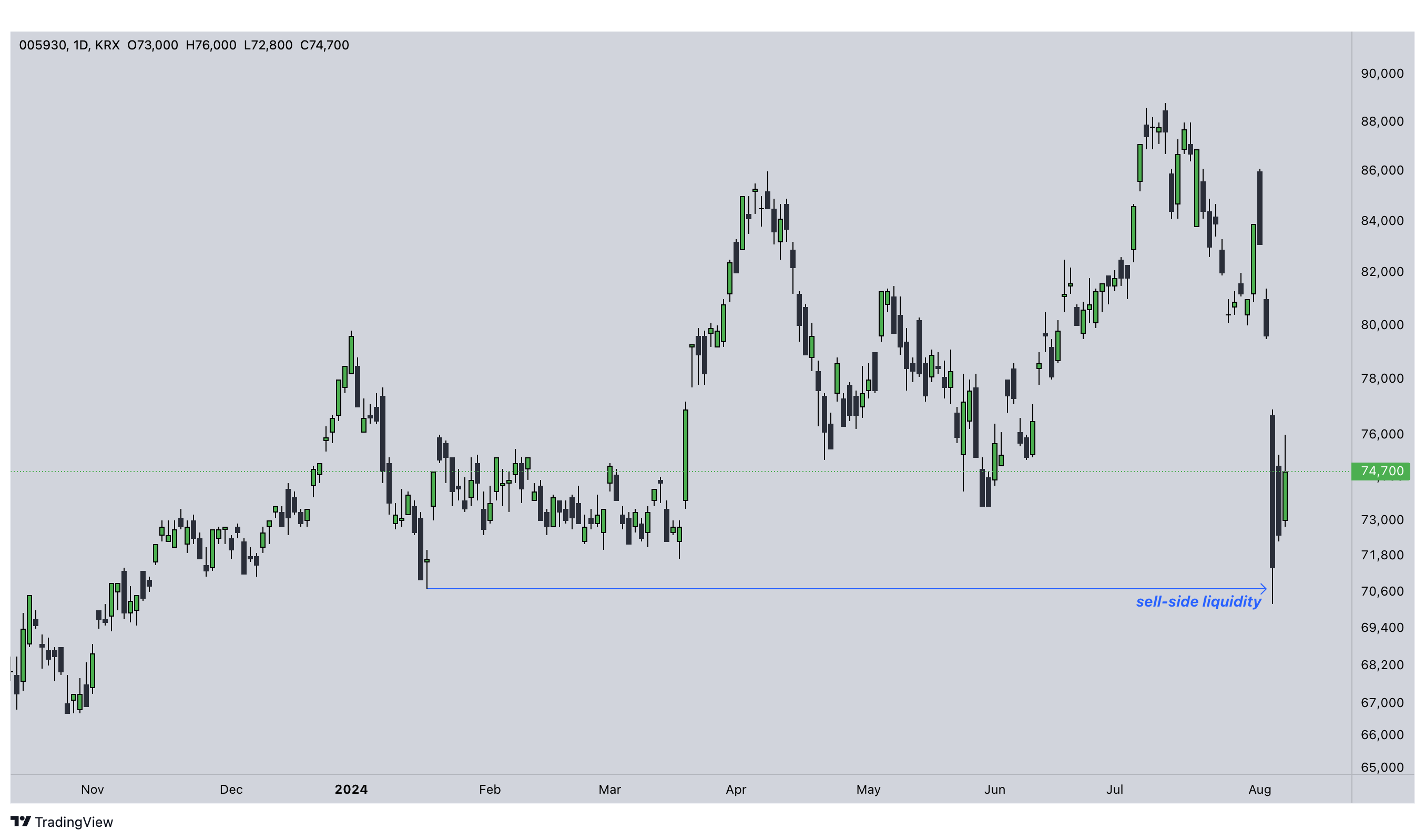

In terms of technicals, Samsung's share price has seen a decline due to a broader stock market correction across the globe, with a large amount of liquidity being taken out, lying below the January lows.* This presents an opportunity for commercial market participants as they can thus execute their orders in the required volume. If investors are considering taking advantage of Samsung's fundamental opportunities, from a technical perspective, the price is currently in a very lucrative position.

The development of Samsung shares on a daily time frame *

Strategic outlook

The successful passage of Samsung's HBM3E chips through Nvidia's tests not only strengthens Samsung's technical capabilities but also increases its competitive advantage in the market for memory chips for AI applications, where high prices are being played for. As the AI industry continues to expand, demand for sophisticated and efficient memory solutions such as the HBM3E will escalate, offering Samsung significant growth opportunities. [3]

* Past performance is no guarantee of future results

[1], [2], [3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

[1] The development of Samsung Electronics shares over the past five years: https://tradingeconomics.com/smsn:ln

.jpg)