Source: CNBC

The selloff on Monday - A Six-Month Low

On Monday, U.S. and European stocks plunged to their lowest levels in six months as uncertainty spilled over the impact of the Trump administration’s aggressive and unpredictable foreign policies. Investors were particularly rattled by concerns surrounding widespread tariffs and their potential to spark inflation and slow economic growth. The tech-heavy Nasdaq Composite plummeted 4%, its biggest one-day loss since September 2022. The S&P 500 followed suit, falling 2.7%. The Dow Jones Industrial Average dropped by 2.1%, shedding nearly 900 points. *

Adding to the negative sentiment, President Trump’s comments over the weekend did little to reassure investors. In an interview with Fox Business, he acknowledged the possibility of a recession and suggested that market volatility was a necessary consequence of building according to him “stronger economy”. His refusal to rule out a U.S. recession on Sunday further rattled Wall Street, reinforcing investor fears that the White House was prepared to endure disruptions without intervening in financial markets.

Asia Follows the Selloff on Tuesday

The market downturn extended to Asia only on Tuesday, since by the time US stock market opens, Asians are already closed. Here major indexes suffered significant declines before regaining ground by the end of the session.

Japan’s Nikkei 225 initially dropped nearly 3% before recovering to close just 0.6% lower. South Korea’s KOSPI slid 2.5% at its lowest point before ending the day 1.3% down. Taiwan’s TAIEX and Australia’s S&P/ASX 200 also saw substantial losses. The hardest-hit sector was technology, with major companies like Sony, Hitachi, SoftBank, and Samsung all seeing sizable declines. *

Wednesday in a sign of a Spark of Hope

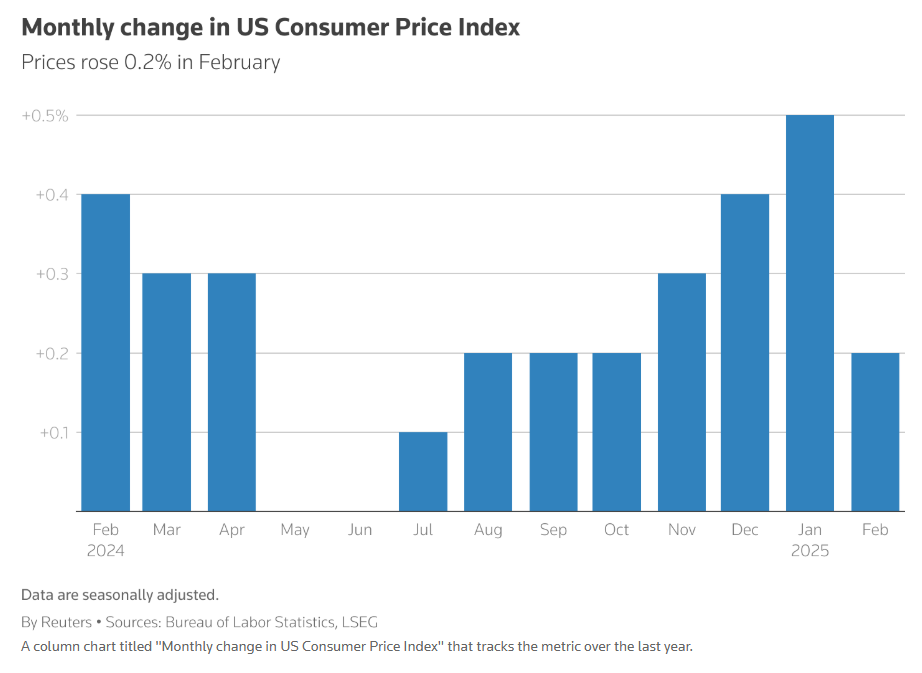

On Wednesday, markets found temporary relief after data showed U.S. inflation slowing to 2.8% in February, down from 3% in January, below the expected 2.9%. This softer-than-anticipated inflation report helped Wall Street snap its two-day losing streak, briefly boosting investor sentiment.

The 10-year Treasury yield, which influences borrowing costs, fell to 4.22% from 4.32% at the previous session’s close. Stock markets in Asia-Pacific responded positively to the news, however, most of them ended Thursday’s session slightly below zero. *

Source: Reuters

Thursday: Selloff Resumes

However, this positive momentum proved short-lived. By Thursday, investor focus had shifted back to global trade tensions caused by Trump’s harmful foreign policies, causing another round of selloffs.

European and U.S. stocks fell again, with the S&P 500 dropping 1.39% to 5,521.52 sliding into the correction phase, the Dow Jones Industrial Average declining 1.3% to 40,813.57, and the Nasdaq Composite shedding 1.96%, driven by losses in Tesla and Apple shares, while the pan-European Stoxx 600 closed 0.15% lower amid mixed sector performance. *

The Takeaway

This week's stock market turbulence underscores the delicate balance between economic policy, inflation expectations, and investor sentiment. While the inflation data provided a brief respite, concerns about trade wars, economic slowdowns, and the Federal Reserve’s next steps continue to drive market movements. As uncertainty persists, investors will be closely watching for any signs of stability in the coming weeks.

* Past performance is no guarantee of future results.

.jpg)