What Does ECB Lowering Rates Mean and How Does Asian Markets Differ?

The Key Will Be Next Data Readings

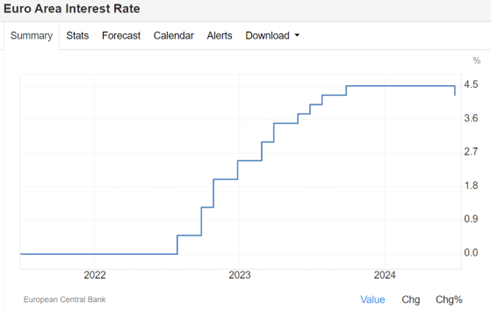

ECB has lowered record-high interest rates almost two years after the first hike in 2022At the start of the year, investors and analysts were expecting from ECB five rate cuts this year. Due to the stickiness of inflation, which stopped easing at 2.5%, central bankers were constrained to keep the high rates for a longer time. Now, besides this rate cut, one or two more rate cuts are expected. Possible dates are speculated to be in September and December meetings.

The ECB is keeping a very close eye on data readings to determine the suitability of changes in its monetary policy. The probable cause of lowering rates might be the stagnation of the euro area economy. Since the fourth quarter of 2022, GDP growth has been 0%, ± 0.1 %. The ECB has taken this step of well-announced monetary decision even though the lingering prices and wages are currently pro-inflationary.

Source: https://tradingeconomics.com/euro-area/interest-rate

Similar Trends in Western Economies

The ECB's point of view is similar to other Western central banks. Some of them have already started the interest rate-lowering cycle, namely Sweden, Canada, and Switzerland after evaluating the decrease in inflation as being on the right track.

The biggest central bank still waiting to enter this cycle is the US Federal Reserve System. Due to this incredible uncertainty, every single speech given by Fed representatives is deeply analyzed. At the next Fed meeting on July 12th, there might be more light shed on the matter, even though a rate cut is not expected at this moment.

Different Trends in Asian Countries

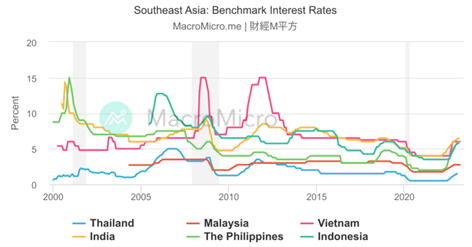

Asian economies display unique trends due to their differing structures. Unlike Western countries, which entered the 2020 COVID crisis with near-zero interest rates, most Asian countries had higher rates, except for Japan and South Korea. Notably, China's rates were even above 4%.

In the post-COVID period, this trend continued, with interest rates in the largest Asian economies not increasing as much as in Europe or the USA. As a result, the combined effect of lower initial interest rates due to COVID and their subsequent modest increases to combat inflation has led to overall lower interest rates in these regions. This scenario is expected to boost both stock markets and economies.

Conclusion

With global economies entering a new cycle with lower interest rates, as signaled by the European Central Bank today, there lie opportunities for both economies and stock markets to perform better under cheaper funding. Investors can use this paradigm shift by exploring global markets.

.jpg)