Apple's Results

Apple reported that second fiscal quarter revenues decreased by 4% to $90.8 billion, surpassing analysts' average estimate of $90.01 billion. For the current quarter ending in June, Apple's CEO Tim Cook told Reuters that the iPhone maker expects low single-digit revenue growth. Wall Street expects revenue growth of 1.33% to $82.89 billion.

Earnings for this quarter amounted to $1.53 per share, exceeding Wall Street's estimate of $1.50 per share. The company also announced a 4% increase in dividends for the current quarter to 25 cents per share.

During the second fiscal quarter, iPhone sales revenues declined by 10.5% to $45.96 billion compared to analysts' expectations of $46 billion. Revenues in the services segment, which includes Apple Music and Apple TV, increased from $20.9 to $23.9 billion, slightly exceeding analysts' expectations of $23.27 billion.

Market Reaction

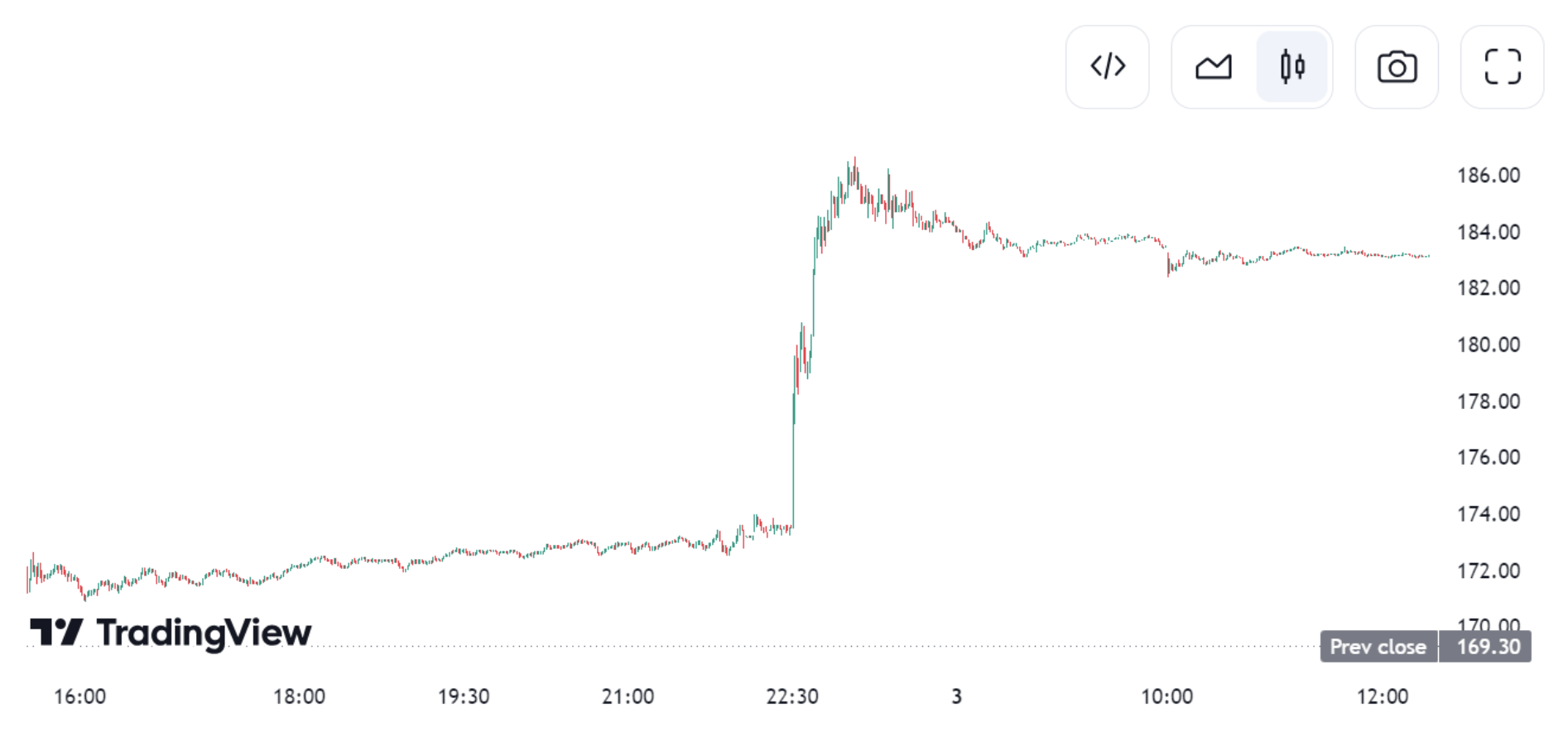

The market's response to these results was minimal, but after the market closed, shares rose by 6%.* The main reason was the announcement of the largest share buyback in the company's history. Apple plans to repurchase its shares for a total of up to $110 billion.

Source: https://www.tradingview.com/symbols/NASDAQ-AAPL/

Artificial Intelligence Segment

In his speech, Cook emphasized optimism about Apple's prospects in generative artificial intelligence. According to his statements, the company has spent $100 billion on artificial intelligence research and development over the past five years.

However, Apple's biggest competitors have spent comparable or even larger amounts on artificial intelligence over the same period. Much of the expenditure goes towards building massive data centers, which are crucial for training generative models.

Microsoft spent $14 billion on capital expenditures in the last quarter, while Google is not far behind with $12 billion. Meta Platforms announced to investors last week that they expect up to $40 billion in capital expenditures this year. However, Apple uses third-party services, saving on its own costs. This model has proven successful for the company in its primary focus areas – consumer electronics products and services. Therefore, its capital expenditures for the entire year of 2023 are slightly over $10 billion, which may be sufficient.

Why Invest in Apple Then?

Compared to the results of its closest competitors, Apple is currently lagging. With the share buyback program, low costs, and promising AI results, it is becoming increasingly attractive to investors who can take advantage of this opportunity.

* Past performance is no guarantee of future results.

https://www.reuters.com/technology/apple-aims-tell-an-ai-story-without-ai-bills-2024-05-03/

.jpg)

.jpg)