Tesla vs. BYD: Earnings

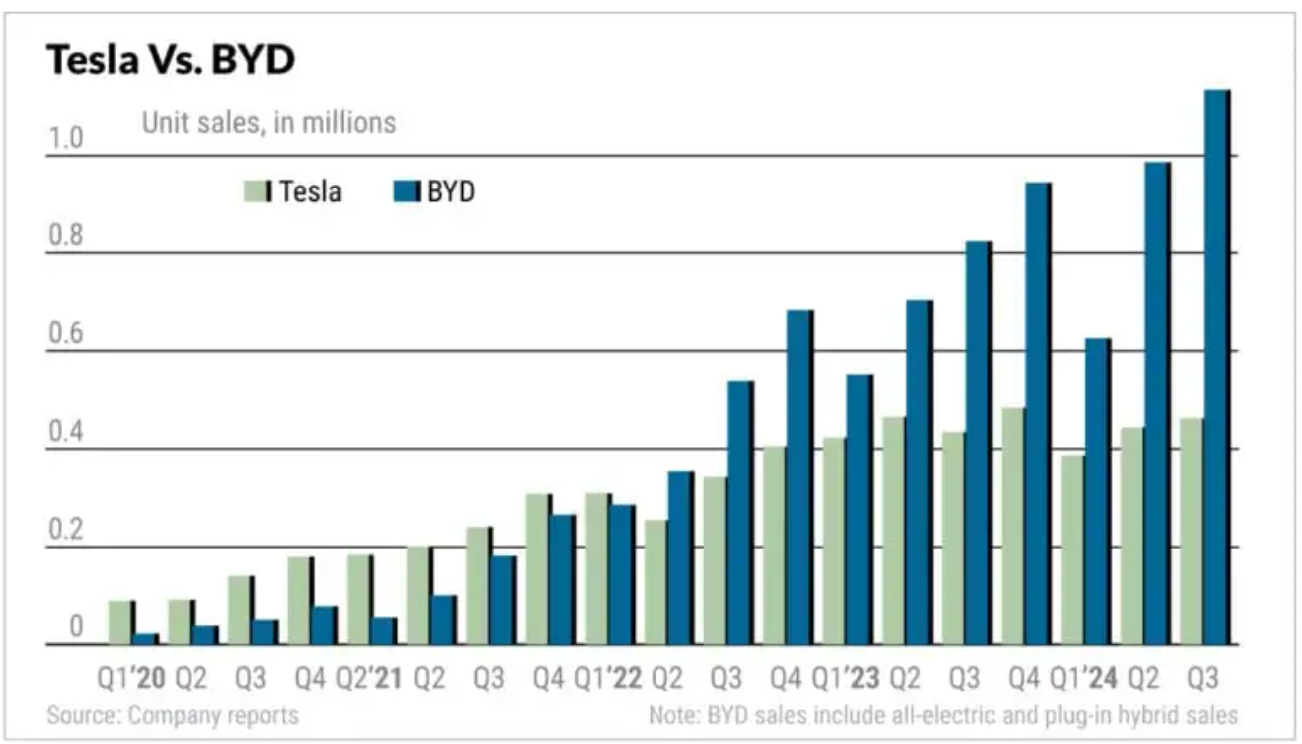

Chinese electric vehicle giant BYD set new records in the third quarter, with revenue up 24% year-over-year to $28.24 billion—its highest ever. This increase follows the previous quarter’s $24.75 billion. By comparison, Tesla reported revenue of $25.18 billion last week, slightly down from $25.5 billion in the prior quarter. This marks the first time BYD has outpaced Tesla in quarterly revenue.

Last week, Tesla’s third-quarter earnings release triggered an 8.4% rise in its stock, fueled by a 17% increase in net income compared to the same period last year. Tesla also expects higher fourth-quarter deliveries, and Elon Musk hinted at more affordable EV models priced under $30,000, aiming to reach a broader consumer base.

On the other hand, BYD’s continued outperformance is evident in its market share, where it holds over a third of China’s EV and plug-in hybrid sales, having surpassed Tesla in Q2 2022. While Tesla remains focused solely on EVs, BYD’s diversified product line—offering both EVs and plug-in hybrids—gives it a distinct advantage in the Chinese market, where versatility in vehicle types is in high demand.

Strong Financial Results by BYD

Further, BYD’s net profit for the third quarter reached $1.63 billion, a 12% rise from last year, with year-to-date net profit up 18% to $3.54 billion. Earnings per share for the quarter climbed to $0.56, a 12% increase, while the year-to-date EPS jumped 180% to $1.22.

These results were also propelled by September sales numbers, where BYD reached a record monthly sales figure of 417,000 vehicles. Together with competitors like Tesla, BYD benefited from China’s “old-for-new” incentive program, which boosted car sales nationwide, reversing a five-month downturn.

Despite record revenue, BYD’s stock fell by 4.3%, as investors’ expectations for profit per vehicle were not fully met. Profit per car rose to $1,600 in the third quarter, up from $1,200 in the second quarter and $1,300 from the previous year, indicating more modest growth than anticipated.

Expansion and Growth Opportunities

BYD stands out as one of the few EV companies in China likely to meet, but not exceed, its sales estimates for the year. However, this could present an opportunity for investors, as it may have contributed to BYD’s recent, possibly short-term, stock outperformance. Analysts forecast fourth-quarter earnings per share between $0.53 and $0.69, with revenue projections ranging from $27.82 billion to $32.59 billion, which could boost the company’s performance even more. Additionally, BYD’s expansion plans into the U.S. and European markets could further drive growth, strengthening its position as a leading global EV player.