Surprising rate cut

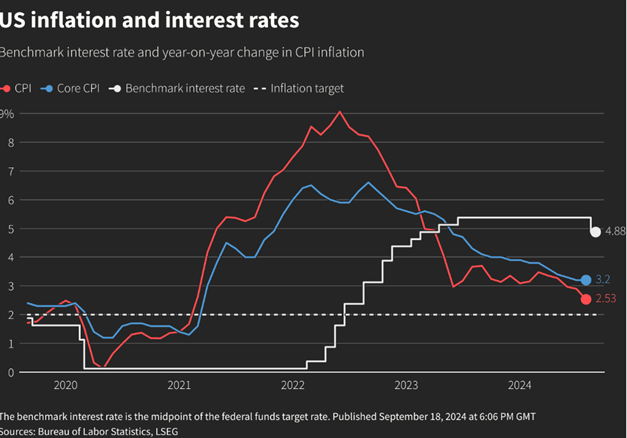

On Wednesday, the U.S. central bank begins a highly anticipated series of interest rate cuts. While most analysts expected a quarter-point reduction, the Federal Reserve surprised markets with a larger-than-expected half-percentage-point cut. Federal Reserve Chair Jerome Powell explained that the decision underscored the Fed's commitment to maintaining low unemployment as inflation has decreased to below 3%, approaching the 2% target.

The Fed cut the benchmark rate by 50 basis points to 4.75%-5.00%. "We made a strong start, and I’m very pleased with the decision," Powell said during a press conference. "The logic of this both from an economic and risk management standpoint was clear."

However, Powell, who typically seeks full consensus, encountered dissent from Fed Governor Michelle Bowman—the first such discord since 2005. Bowman voted for a smaller quarter-point rate cut, signaling her preference for a more cautious approach. According to sources, as many as nine out of 19 policymakers expressed reservations about the aggressive rate cut, raising concerns that will require close monitoring in the coming months.

Source: Reuters

Market Reaction: New All-Time Highs

U.S. stocks rallied sharply on the news, with the Dow Jones Industrial Average rising 1.2%, closing above 42,000 for the first time ever. Optimism that the Fed's rate cut will support a "soft landing" for the economy drove the surge. The S&P 500 jumped 1.7%, hitting a record high of 5733.75 points, while the tech-heavy Nasdaq Composite led the gains with a 2.5% increase.*

The "Magnificent 7" group of tech stocks also performed well, with Nvidia jumping nearly 4%, Tesla rising more than 7% and Apple gaining over 3%. Meanwhile, the U.S. dollar weakened, as lower interest rates reduced the appeal of U.S. bank yields, prompting bondholders to move funds into more profitable currencies.

Asian Market Response

Asian stocks followed the U.S. lead, with MSCI's broadest index of Asia-Pacific shares outside Japan rising 0.6% to its highest level in two months. The index is on track for a weekly gain of 2.4%.*

Japan's Nikkei rose 1.5% and is up 3.1% for the week, while the yen, which had rallied 14% from its July lows, stabilized at 142.21 per dollar. In other markets, Hong Kong's Hang Seng gained 1.26%, South Korea's KOSPI increased by 0.49%, and Taiwan's stock index rose by 0.53%.*

* Past performance is no guarantee of future results.