Lower-Than-Expected PMI

In August 2024, the ISM Manufacturing PMI edged up slightly to 47.2 from 46.8 in the previous month, missing market expectations of 47.5. Among its components, only industrial prices recorded a retraction, with a score of 54 compared to expectations of 52.5. New orders, backlog orders, employment, and production all hovered between 40 and 50, indicating potential risks to the broader economy.

Nervous markets interpreted this data as a potential economic threat, increasing their focus on upcoming speeches by Federal Reserve representatives. At its meeting on September 18th, the Fed is expected to lower interest rates by 25 basis points, with a 40% chance of a 50-point reduction. This rate cut is anticipated to boost the US economy as it concludes its battle against high inflation.

In addition, China's Services PMI declined to 51.6 in August 2024 from 52.1 in July, falling short of market expectations of 52.2 amid slowing new order growth and a slight drop in employment.

Source: Reuters

Market Reactions

Markets responded with heightened volatility, the highest since the stock market's unprecedented drop on August 5th. Oil prices slumped 5%, the largest drop this year, reflecting investor concerns over US and Chinese economic growth, as a weaker economy typically leads to lower oil demand. The Nasdaq fell by 3.26%, and the S&P 500 dropped 2.12%.

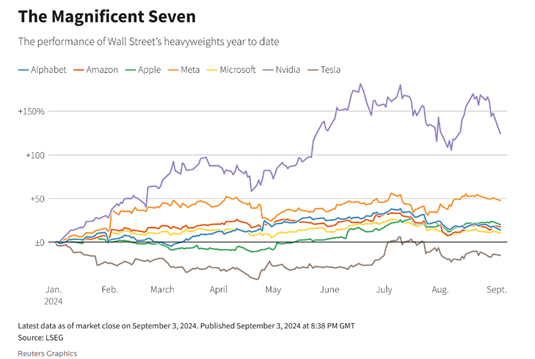

Nvidia’s shares plunged 9.5%, wiping out approximately $265 billion of the company's market value in one of the largest one-day market cap losses on record. Nvidia's decline was partly due to a US Department of Justice subpoena as part of an investigation into possible antitrust law violations. Given that Nvidia has been a key driver of the AI rally over the past 18 months, such a significant sell-off is concerning. Other tech stocks also fell sharply: Intel dropped 8.8%, AMD fell 7.8%, and Qualcomm lost nearly 7%. The VanEck Semiconductor Index declined by 7.5%.

Asian markets were also hit hard, with Japan’s Nikkei 225 falling 4.24%, South Korea’s Kospi dropping 3.15%, and Taiwan’s stock market declining 4.52% amid a current outflow of foreign investments from these countries. The pan-European STOXX 600 index opened the trading day down 1%, with all other major European markets also down around 1%.

How Likely Is a US Recession?

Despite negative manufacturing PMI, slight increase in unemployment within an otherwise stable labor market and a higher-than-expected revision of US GDP growth (up from 2.8% to 3.0%), the US economy does not appear to be at immediate risk of recession. With a period of interest rate cuts on the horizon, it is even more likely that the US will avoid a hard landing. The Federal Reserve remains ready to intervene if signs of a recession begin to emerge.