Source: https://www.cnbc.com/quotes/US10Y

Macroeconomic Pressures

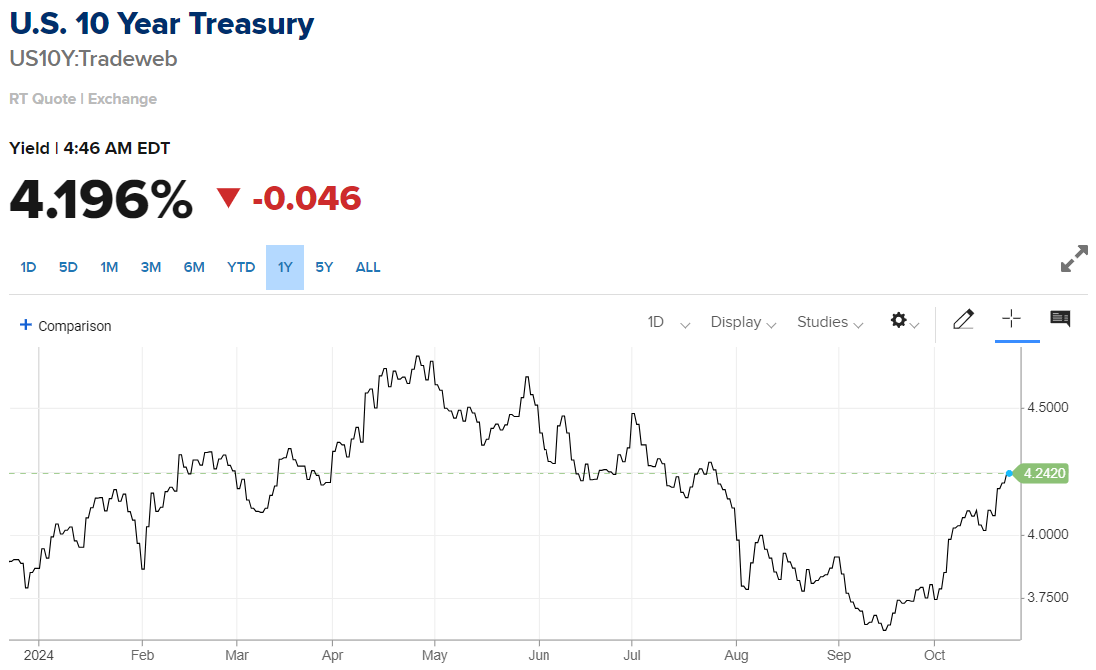

Since the Federal Reserve lowered interest rates last month, 10-year U.S. Treasury bonds yields have surged by half a percentage point. This contradicts traditional economic theory, which predicts declining yields following a rate cut. However, the explanation is simple: investors are demanding further easing in U.S. monetary policy to be convinced that borrowing costs will truly fall.

Higher yields encourage investors to allocate funds to safe-haven assets like Treasury bonds, which offer fixed returns, rather than to the stock market, which is near record highs. Additionally, some key U.S. companies are facing difficulties.

Challenges of U.S. Companies

The technology sector continues to face significant challenges. Prominent tech stocks, which have surged during the AI-driven rally and hold a large weight in the index, have been underperforming since the summer. On Wednesday alone, Nvidia dropped 2.8% and Apple fell 2.2%.*

The consumer staples sector is also feeling the strain. Coca-Cola reported its third-quarter earnings, which exceeded market expectations. However, a decline in global sales volumes of the company’s concentrates led to a 2.1% drop in its stock price.*

A major shock came from McDonald's, which fell 5.1% after federal health officials linked its burgers to an E. coli outbreak that has affected at least 49 people in 10 states.* The investigation is still ongoing, but McDonald's has already taken a significant hit, including a blow to consumer sentiment.

Lastly, Boeing reported a $6 billion loss for the latest quarter, causing its stock to drop 1.8%.* The company continues to struggle, as a substantial portion of its workforce has been on strike for over a month. Boeing’s stock has lost 40% this year.*

Impact on Asian Markets

Japan's benchmark Nikkei 225 posted a modest 0.1% increase on Wednesday, giving up earlier gains and closing at 38,143.29.* This was largely due to the Purchasing Managers' Index (PMI) data showing deteriorating conditions in both Japan’s manufacturing and services sectors. The composite PMI, compiled by au Jibun Bank, hit a two-year low.

Chinese markets also declined, with Hang Seng losing 1.1% to 20,531.19, while the Shanghai Composite dropped 0.8% to 3,277.35. In Seoul, the Kospi shed 0.7% to 2,581.03, and Australia's S&P/ASX 200 edged 0.1% lower to 8,206.30. Taiwan's Taiex lost 0.6% and India's Sensex slipped 0.1%. Bangkok's SET index declined 0.3%.*

*Past performance is no guarantee of future results.