Source: Gavekal

May Shipments Collapse Amid Trade Strains

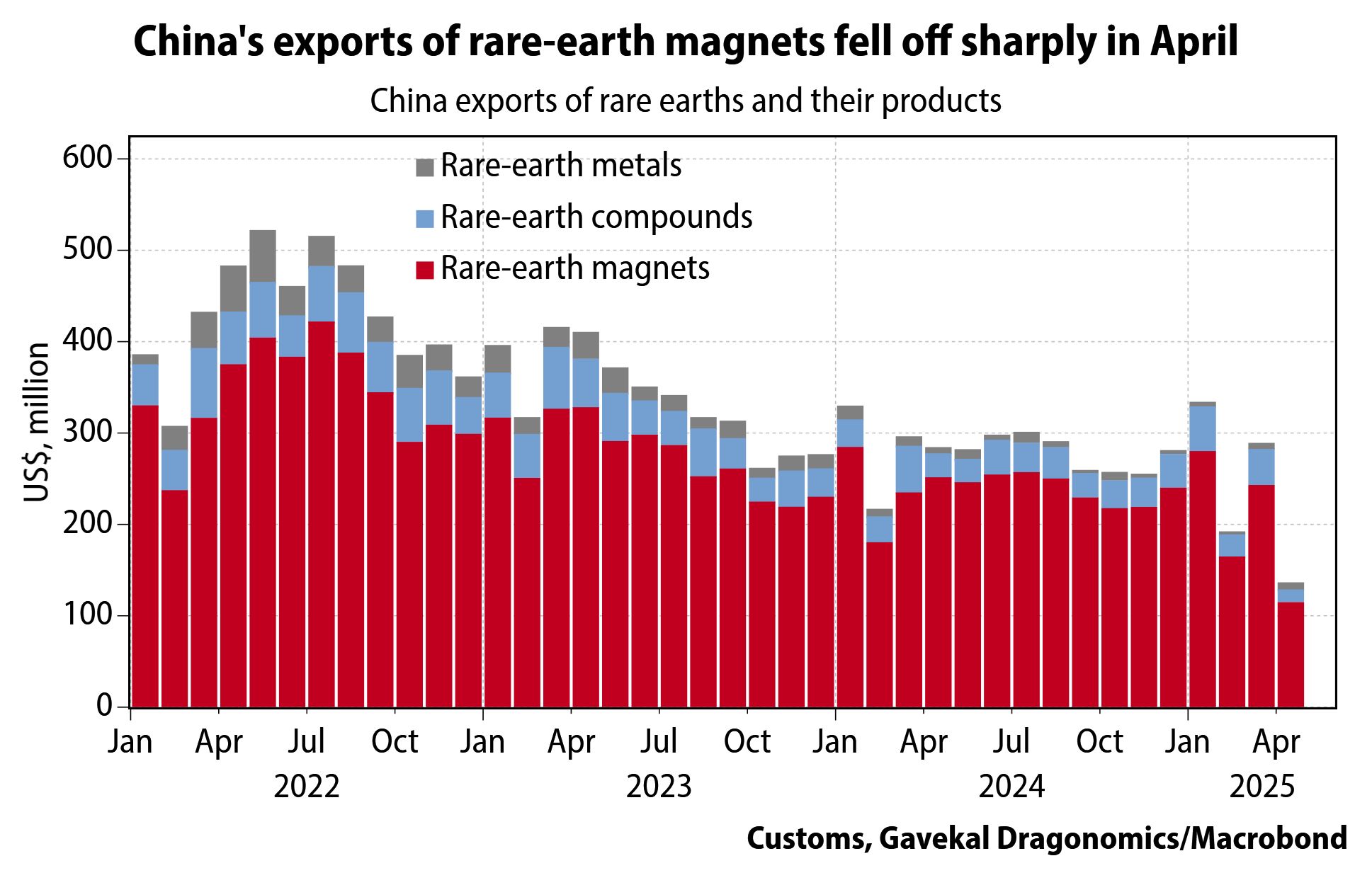

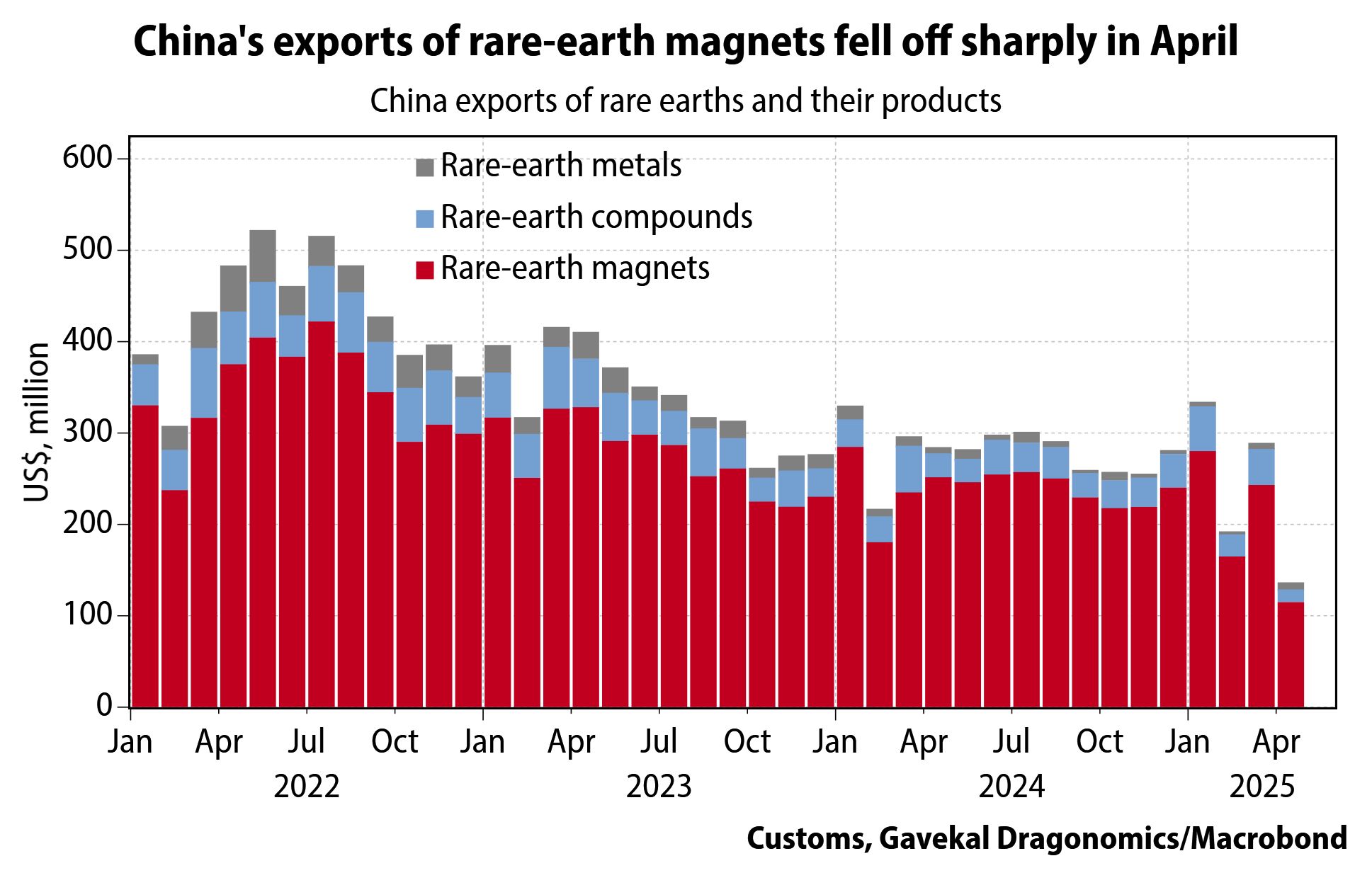

According to data released by China’s General Administration of Customs, exports of rare earth permanent magnets fell to just 1,238 metric tons in May, a 52.9% drop from April and an immense 74% decline year-on-year. This marks the lowest monthly export volume since February 2020, at the height of the COVID-19 pandemic.

Even April had seen a significant drop, with volumes slashed in half from March levels. Overall, exports between January and May totaled 19,132 tons, down 14.5% compared to the same period in 2024, the weakest performance for the first five months of the year since 2021.

The slowdown followed China’s decision in early April to impose new export restrictions on seven types of medium and heavy-rare-earth minerals and magnets. These materials are vital for the production of automotive drivetrains, semiconductor equipment, aerospace systems, or missile guidance technologies.

Customs Hold-Ups and Regulatory Confusion

While Beijing has not fully disclosed the reasoning behind the timing or scope of the new restrictions, analysts and industry insiders suggest they were part of a broader strategic maneuver in its ongoing economic dispute with the United States.

As part of the clampdown, Chinese customs officials reportedly began scrutinizing rare earth cargoes more carefully, especially magnets, which are grouped under a single export product code despite encompassing a range of different compositions. This regulatory ambiguity, sources say, has led to uncertainty and delays in export processing.

In particular, shipments of lower-performance rare earth magnets that are commonly used in consumer electronics and household appliances were held up due to confusion about whether they fall under the new curbs. Several industry insiders, who declined to be named due to the sensitivity of the issue, said customs authorities have become increasingly hesitant in approving exports without explicit licensing.

Easing Tensions and New Licenses

However, a diplomatic breakthrough between Beijing and Washington in early June may signal a turning point. In a joint statement, both countries agreed to reduce tensions and re-engage in trade discussions. As a sign of goodwill, China’s Ministry of Commerce announced that it would accelerate the approval process for rare earth export licenses.

The ministry confirmed that a certain number of applications had already been approved, though it declined to provide specific figures. Leading Chinese magnet producers recently revealed they had secured licenses to resume some overseas deliveries, suggesting that trade activity may soon pick up.

These developments have raised hopes among global manufacturers that supply chain stability could be restored shortly . However, analysts caution that recovery may not be immediate, as bureaucratic hurdles and geopolitical uncertainty continue to cloud the outlook.

. However, analysts caution that recovery may not be immediate, as bureaucratic hurdles and geopolitical uncertainty continue to cloud the outlook.