Extent of the Market Decline

On August 5th, the Dow Jones Industrial Average fell by 2.6%, closing at 38,703.27. The Nasdaq experienced a sharper decline, losing 3.43% to end at 16,200.08, while the S&P 500 dropped 3%, finishing at 5,186.33. Notable individual stocks also suffered significant losses: Nvidia dropped 6.4%, Apple tumbled 4.8%—partly due to Warren Buffett’s announcement that he had halved his Apple shareholding—and Tesla declined by 4.2%.*

The Nikkei 225 in Japan experienced a dramatic 12.4% drop, closing at 31,458.42, marking its worst day since the infamous "Black Monday" crash of 1987. In Europe, the EuroStoxx 50 fell by 2.2%, while Bitcoin, the leading cryptocurrency, plummeted from $62,000 on Friday to around $54,000 by Monday.*

Source:https://www.statista.com/chart/21070/main-policy-interest-rates-in-selected-countries-and-regions/

The End of Cheap Credit

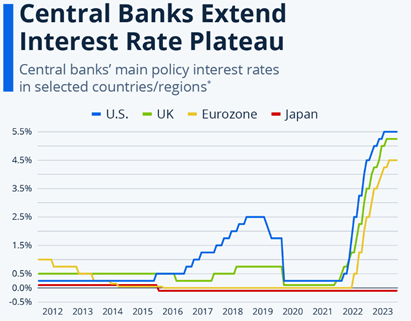

Two weeks prior, we discussed a pivotal shift when Japan unexpectedly raised its overnight interest rate from 0.1% to 0.25%. This decision caught many investors off guard and intensified existing pressures on the stock market, culminating in the significant downturn observed after Japan's announcement.

With U.S. interest rates exceeding 5%, the highest in two decades, and European rates at 4.25%, the second highest in the Eurozone's history, investors had increasingly turned to a complex financial strategy known as the Yen Carry Trade.

The Yen Carry Trade

The Yen Carry Trade capitalized on Japan's comparatively low interest rates. Investors borrowed substantial amounts of Japanese yen at low interest, converted these funds into U.S. dollars or euros, and invested in high-performing technology stocks such as Nvidia and other companies in the semiconductor and AI sectors. The plan was to hold these positions briefly, then sell the stocks, convert the proceeds back into yen, and repay the loan.

However, Japan's interest rate hike disrupted this strategy significantly. First, the higher interest rates made borrowing more expensive, although well-secured loans might mitigate this impact. The second and more critical issue was the appreciation of the yen following the rate hike. As the yen strengthened, investors needed more dollars or euros to repay their yen-denominated loans.

This forced many to sell off larger portions of their stock portfolios, which in turn exerted downward pressure on stock prices. Furthermore, new investments using this mechanism became less viable, further driving down the prices of technology stocks.

Is a More Severe Correction on the Horizon?

Despite the substantial sell-off, both the global economy and stock markets appear to remain stable. There has been a partial recovery, with global stocks rebounding and erasing some of their losses. While the possibility of a recession cannot be entirely dismissed, the current outlook remains cautiously optimistic, with no immediate indications of a more significant market decline on the horizon.

* Past performance is no guarantee of future results.