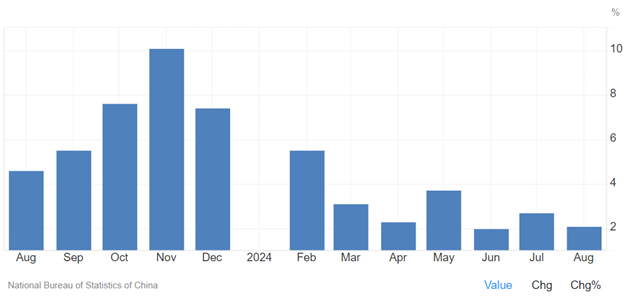

Graph: China Retail Sales

Source: Trading View

China’s Declining Economy

In the second decade of the 21st century, China has experienced a significant slowdown in economic activity, as evidenced by multiple indicators. The roots of this slowdown can be traced to factors like demographics, especially the long-standing one-child policy, but a large portion of the challenges are tied to China’s authoritarian regime. With high levels of uncertainty and a lack of government-approved investment options, many citizens have poured their life savings into real estate. This sector has seen a sharp decline in recent years, starting with the financial troubles of the property giant Evergrande, now the world’s most indebted developer.

The downturn has become more pronounced in the post-COVID era. While many developed economies have seen at least partial recovery, China still struggles with low demand. This weak demand undermines consumer confidence, as reflected in retail sales figures. Furthermore, in the second quarter, China's GDP growth lagged behind expectations, coming in at 4.7%, compared to the anticipated 5.1%. The country’s major lenders are also grappling with shrinking margins, falling profits, and rising bad loans. Four of China’s top five banks reported lower second-quarter profits after complying with government directives to reduce lending rates to stimulate weak loan demand.

A Struggling Stock Market

China’s stock market is also facing difficulties. While the CSI300 index and Hong Kong’s Hang Seng surged more than 15 % in the past week, both remain down by 40% from their February 2021 peaks. In contrast, Japan’s Nikkei is up 24%, and the S&P 500 has risen 45% over the same period. *

Investors noted that while the markets responded positively, the reaction exposed the weak underlying sentiment. The measures introduced failed to address a key concern for most overseas investors: the need for fiscal policies that directly stimulate consumer demand while the stimulus package mainly focuses on injecting liquidity into the markets, which is insufficient in the broader context.

Chinese stocks have been underperforming for years, even as global markets hit record highs. This has led many investors to pull out and avoid exposure to China. More than a quarter of global funds tracked now hold no exposure to China, a sharp decline from near-universal exposure in 2021.

Government Stimulus: Is It Enough?

Limited information is available on the specific measures that will be implemented, but the stimulus package includes those above 1 trillion yuan injection, “forceful” interest rate cuts, and possible adjustments to fiscal and monetary policies. With specifics unclear, markets have largely focused on the liquidity injection.

But will it be enough? Will the Chinese central bank and authoritarian government manage to address the imploding Chinese economy? In this situation, I lean more toward the analysts underscoring the need to change fiscal policies rather than monetary policy of China.

*Past performance is no guarantee future results.