Source: Reuters

Trump backed down on the tariff deal.

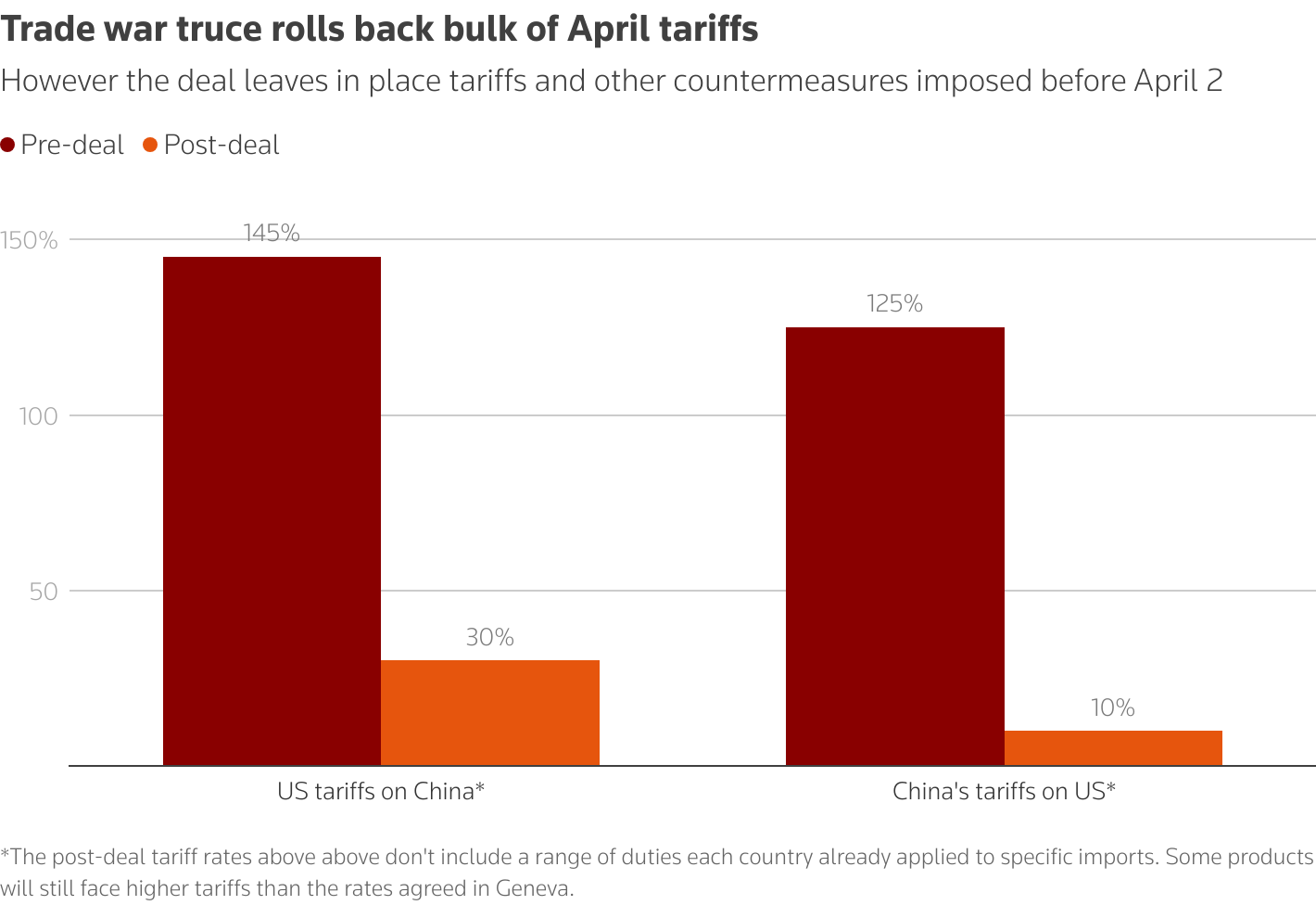

This trade agreement between the United States and China marks a significant de-escalation of one of the most disruptive economic conflicts in recent years. Under the deal, both sides agreed to pause or reduce steep reciprocal tariffs for 90 days. The US rolled back some tariffs from 145% to 30%, while China lowered its duties on US goods from 125% to 10%.

Financial markets reacted swiftly and positively to this trade 'truce', with global stock indices surging on the news. The S&P 500 reached its highest level since early March, while the Nasdaq recorded its strongest close in over two months. Trump’s decision to back down on tariff hikes eased investor fears of a prolonged trade war. This boosted confidence across equities while lowering gold prices and strengthening the U.S. dollar. All of them point to renewed optimism about global economic stability.

Effects on the supply chain

Retailers and logistics executives are bracing themselves for a surge in shipments from China to the US, as businesses rush to take advantage of the tariff reprieve. What has been a rush to import as many goods to the US as possible before tariffs kicked in is now shifting into importing as much as possible before leaders of the world’s two largest economies change their minds.

Freight data show that ocean import volumes were already up 11% year-on-year, even before the deal was made, and experts are warning that ocean freight prices could increase by 20% due to renewed demand.

Even though the fear of a US recession has dropped for now, the possibility of price hikes remains. Prices or increased shipping fees due to higher demand remain a possibility. However, supply chains have been affected worldwide, and it may take time to rebuild them.

What will follow?

While the agreement has not addressed deeper structural issues brought by Trump, such as the US trade deficit or Chinese subsidies, many analysts believe that this pause will be extended. This is because there is a growing expectation in the market that the Trump administration cannot afford to reintroduce them again.

Looking ahead, the next few months will be critical. The surge in shipments is likely to continue through the next few quarters as importers prepare for the holiday season. Although the agreement is only temporary, the diplomatic breakthrough suggests that both sides are under pressure to avoid renewed escalation, which offers hope for a more permanent resolution in the future.