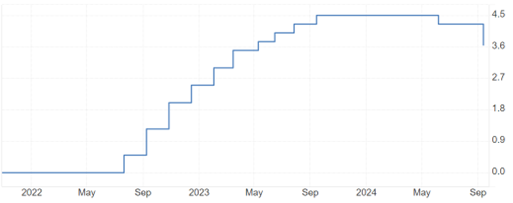

Graph: Main refinancing operation rate of ECB

Source: https://tradingeconomics.com/euro-area/interest-rate

ECB Interest Rate Cuts

The European Central Bank has reduced all three of its main interest rates as part of its efforts to ease monetary policy, reflecting updated inflation forecasts. Specifically:

The deposit facility rate was cut by 25 basis points, bringing it down to 3.5%.

The main refinancing operations rate was reduced by 60 basis points to 3.65%.

The marginal lending facility rate was also decreased by 60 basis points to 3.90%.

These new rates take effect on September 18th. The ECB remains committed to bringing inflation back to its 2% target, with future rate adjustments determined by economic data and conditions, rather than a predefined rate path.

By lowering the deposit facility rate by just 25 basis points compared to the more significant 60-basis-point cuts for the refinancing and lending rates, the ECB is signaling a focus on encouraging borrowing for new loans and reducing interest on existing loans. However, it appears to be limiting the flow of “existing” money, such as bank deposits, into the broader European economy. This strategy aims to bring inflation even closer to the 2% target without triggering a recession.

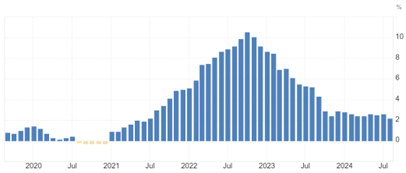

Graph: Inflation in Euro Area

Source: https://tradingeconomics.com/euro-area/inflation-cpi

What to Expect from the Fed

On Wednesday of next week, the Federal Reserve is expected to lower its interest rates by 25 basis points, setting the new range between 5.00% and 5.25%. Federal Reserve Chair Jerome Powell hinted at this decision during his speech at the Jackson Hole Economic Symposium, citing concerns over a cooling labor market and the risk of an economic downturn in the U.S.

Another factor behind the expected rate cut is the success of recent monetary policies. U.S. inflation has slowed for the fifth consecutive month, reaching 2.5% in August—its lowest level since February 2021—down from 2.9% in July, and below the forecast of 2.6%.

Possible Scenarios

While most analysts anticipate a 25-basis-point reduction, there is a case for a larger 50-basis-point cut to provide a stronger boost to the economy. A 25-basis-point cut and a cautious statement from Chairman Powell could lead to a sharp decline in the stock market. Conversely, a 50-basis-point cut, along with a more optimistic outlook, could propel the S&P 500 to new all-time highs.[1]

Navigating the mid-September market volatility will depend largely on how the central banks' decisions are received and their broader impact on investor sentiment.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.Spodná časť formulára